Discover more about S&P Global’s offerings

A Report By The China Senior Analyst Group

Published: October 1, 2018

U.S. trade and investment policies may slow technology transfer unless China does more to protect intellectual property, widen market access for foreign firms, and level the playing field with domestic champions. The trade balance is of second-order importance.

China needs foreign technology to deleverage and sustain catch-up with rich countries. China is producing more of its own technology but our research confirms that foreign firms still provide key inputs along its supply chains through trade and investment.

The short-term effects of this "Great Game," absent a substantial escalation, are manageable. China can offset the impact of higher tariffs through domestic stimulus and allowing the exchange rate to depreciate.

If a resolution is not found, the long-term effects on China's macro-credit prospects are underestimated. Slower tech transfer means slower potential growth. China might resort to excessive stimulus and low quality, credit-intensive growth in a bid to sustain rapid catch-up.

Download the full report here.

Technology is at the heart of a new "Great Game" between the United States and China and this is a game that matters. More than shrinking the bilateral trade deficit, the focus of U.S. trade and investment policies has turned to technology. There is a geopolitical dimension to this but economics are also prominent. U.S. grievances focus on areas where technology predominates, including protection of intellectual property, access to fast-growing Chinese markets for U.S. firms, and a level playing field versus domestic Chinese champions.

As the world adjusts to a rising China, friction is being felt across trade and investment relationships. One common thread underlying these frictions is technology--how it is traded, transferred, and regulated.

As the focus broadens from trade to technology, the stakes for China rise. China's rebalancing and catch-up to rich countries relies, perhaps more than anything else, on the rapid and efficient deployment of new technology across its economy. The country can no longer count on a growing pool of labor or a fast pace of debt-financed investment. China will instead need to allocate its capital more efficiently into assets with high marginal returns, and that also foster higher paying jobs. These assets are likely to be technology rich.

In this report, S&P Global's China Senior Analyst Group dives deeper into what's really at stake for China in this tussle with the U.S. over trade and investment. We start with a macro overview and then focus on what the tussle might mean for technology supply chains, often the source of technology and growth spillovers for emerging economies.

American Pivot To China And Technology

U.S. policymakers may want to pivot their economic and financial focus toward China for many reasons. These include strategic and geopolitical competition, a desire to encourage a deep and persistent shift in the direction of China's economic reforms, and a narrower focus on bilateral trade imbalances. These motivations are not mutually exclusive but the shifting emphasis between them has confused observers about what the U.S. wants to achieve.

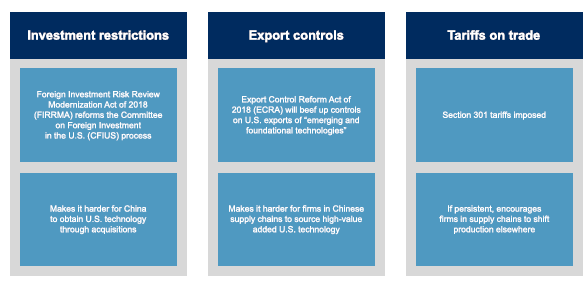

U.S. policy, though, is converging on a strategy that is consistent with all of these motivations: slowing the pace at which China acquires new technology and deploys its own technology overseas. We see three broad fronts in this effort:

U.S. Investment Restrictions And "Critical Technologies"

Some of these efforts hardwire changes into the U.S.-China relationship, unlike tariffs which can be rolled back easily. For example, the Foreign Investment and Risk Review Modernization Act (FIRRMA) of 2018 encodes higher scrutiny of foreign investment into U.S. legislation. This act widens the scope of the Committee on Foreign Investment in the United States (CFIUS), for example to include review of foreign investments which could result in the change of control in a target U.S. business involved in "critical technologies." The pilot program covers 27 industries including batteries, computer storage, nanotechnology, biotechnology, semiconductors, and wireless communications equipment (1).

U.S. Export Controls And "Emerging Technologies"

The Export Control Reform Act (ECRA) of 2018 was passed at the same time. This permanent statute authorizes the U.S. Commerce Department to establish controls on the export of "emerging and foundational technologies." The U.S. is clear in its intentions. Any export controls must take into account their "effectiveness on limiting the proliferation of emerging and foundational technologies in foreign countries."

An Executive Branch review of the scope of ECRA is currently underway. A public consultation has already closed and the comments from a wide range of U.S. technology firms and industry groups have been published on a U.S. government website (2).

Countries Of "Special Concern" For The U.S.

While such legislation applies to all U.S. trading partners, there is little doubt that China, as one of the "countries of special concern," will be most affected. Senator John Cornyn, a sponsor of the FIRRMA legislation, has said that "CFIUS was created not with China in mind. [But] now we are focused on the most aggressive country in terms of gaining that technology edge or closing that technology advantage we have—China."

This has become a bipartisan effort in the U.S. Senators Marco Rubio, a Republican, and Mark Warner, a Democrat, introduced legislation earlier this year that would create an Office of Critical Technologies & Security at the White House. In a statement, Senator Warner noted that "we need a whole-of-government technology strategy to protect U.S. competitiveness in emerging and dual-use technologies and address the Chinese threat by combating technology transfer from the United States."

Even before the new legislation, Chinese technology firms had begun to be affected by a hardening U.S. stance. In 2016, the U.S. was able to block a Chinese investment fund's acquisition of a German semiconductor producer because of the latter's U.S. subsidiary (3). Since 2017, about 50 Chinese outbound deals have been subject to CFIUS review, and less than half appear to be have been passed (4). The rejection rate appears to be somewhat higher in some technology sectors, including semiconductors (5). In 2018, two important Chinese technology firms that relied on foreign semiconductor technology, ZTE Corp. and Fujian Jinhua Integrated Circuit Co. Ltd., were hit by export controls. Both firms were accused of illicit technology transfers.

U.S. Tariffs And Technology

Tariffs dominate headlines but they are only one part of the three-pronged U.S. policy effort. Technology is being caught in the tariff net for a couple of reasons.

First, technology has become a major export from China to the U.S. In 2017, telecom equipment (including cell phones) and data processing equipment accounted for about 25% of total exports to the U.S. A further 25% or so was electrical machinery, much of which includes technology to varying degrees.

Second, the U.S. Trade Representative's Section 301 list of products has, until now, focused much more on intermediate and capital goods--which have become more technology-intensive over time--rather than consumer goods. This approach naturally excludes low-tech consumer goods such as furniture, textiles, and luggage.

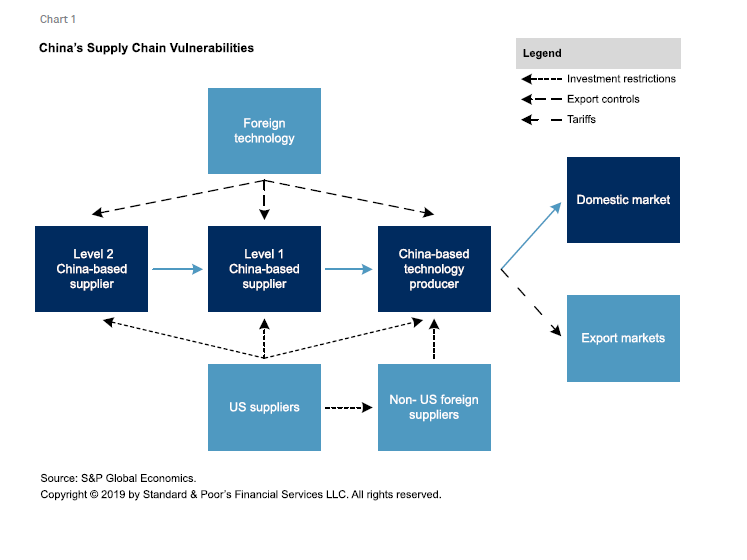

Rewiring China's Supply Chains

U.S. investment restrictions, export controls, and tariffs could rewire China's technology-intensive supply chains. Chart 1 oversimplifies but provides a sense of how supply chains could be affected and "domesticated." Some effects could be identifiable in the short run, for example the impact on export demand from higher tariffs (if Chinese producers pass tariffs on to their foreign customers). Other effects may take longer to emerge, including a slower infusion rate of new technology in the production process. This would render China-based firms less competitive over time, strengthening incentives to relocate supply chains.

Technology Moves Center Stage In China's Policies

"[China needs] concerted endeavors and strategic arrangements in key cutting-edge technologies and in fields subject to other countries' control to achieve innovative breakthroughs."--President Xi, 19th Meeting of the Chinese Academies of Sciences and Engineering, May 2018

Xi Jinping laid out his vision for China through 2035 at the 19th Party Congress in 2017. First in a list of goals he expected to be met by then was for China to emerge as a global leader in technology, saying that "China's economic and technological strength has increased significantly. China has become a global leader in innovation." He went on to say that transforming China's growth model and fostering new drivers of growth is "an urgent requirement for getting us smoothly through this critical transition and a strategic goal for China's development."

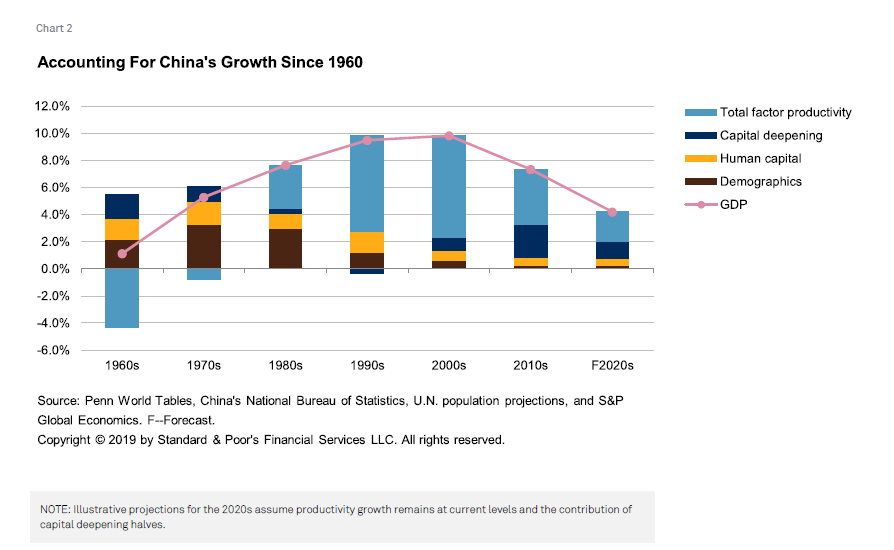

We agree with President Xi. Innovation-driven growth will be required for China to achieve a smooth deleveraging and sustained catch-up to its rich G-20 peers. It's well known that the old model of growth has run out of steam. To see this, consider China's growth performance since 1960 through a supply-side lens. Improving productivity drove surging growth in the two decades following Deng Xiaoping's opening up in 1978. This productivity boom was sustained in the 2000s as WTO entry allowed China to harvest the fruits from reforms of state-owned enterprises (SOEs) made by Premier Zhu Rongji in the previous decade. In the 2010s, however, productivity gains have faltered. Credit-driven investment in low return capital has propped up growth.

Technology Must Drive Growth In China…

As we look ahead, China must arrest slowing productivity gains to engineer a smooth rebalancing. Continued credit-fueled investment growth would mean ever-increasing debt-to-GDP ratios and a rising probability of a financial crisis. Nor can China rely on a demographic dividend, because the labor force has stopped growing and, in our view, most rural residents that are willing and able to work in the cities have already migrated. The only driver left is productivity growth and this will not come from the textile or steel sectors or the property market. Without new ways of doing business, enabled by technology, it won't even come much from the flourishing services sector.

Our contention is that China will need to acquire and deploy advanced technology quickly and efficiently throughout the economy if it is to support productivity and stop growth from slowing too sharply over the next decade.

…And It Is Already Driving Growth

Some estimates suggest that China's tech-driven "new economy" has expanded about twice as fast as the overall economy over the past decade, and created 20 times the number of jobs than traditional sectors (6). While probably large, the impact is also highly uncertain. It is hard to measure all the different ways technology can boost growth, from a map on a delivery driver's smartphone to e-payments. This is why economists tend to rely on abstract concepts such as total factor productivity.

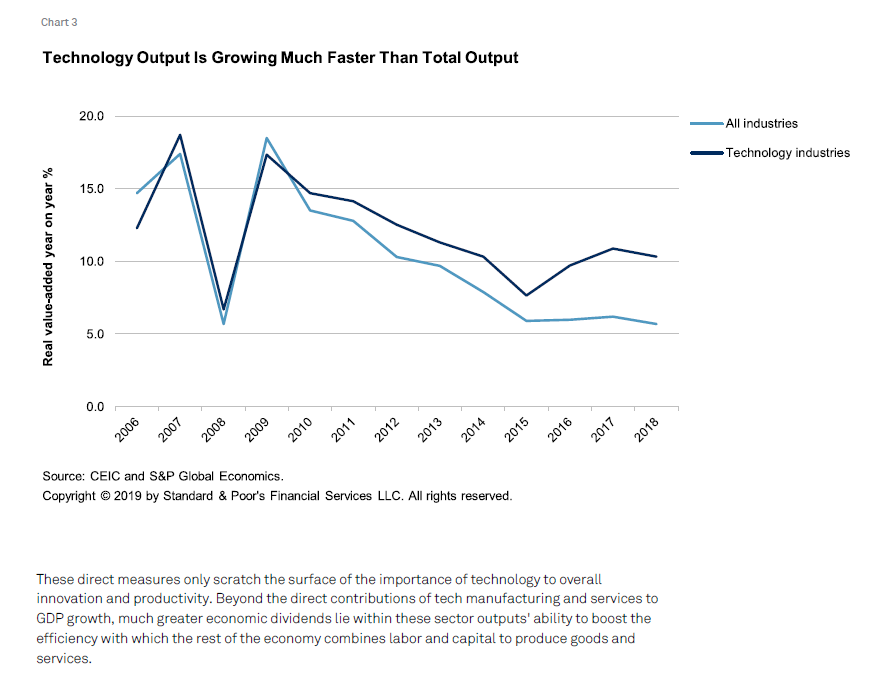

We can assess technology's contribution in a more limited but direct way through the value added by the industries that produce technology goods. Over the past 10 years, these industries (including electric machinery, computer, communication and other electronic equipment) have grown about 2 percentage points (ppts) faster than overall output. That gap has risen to 5ppts more recently. Also, the new GDP measure of information technology services increased by an average of over 20% per year between 2015 and 2017.

These direct measures only scratch the surface of the importance of technology to overall innovation and productivity. Beyond the direct contributions of tech manufacturing and services to GDP growth, much greater economic dividends lie within these sector outputs' ability to boost the efficiency with which the rest of the economy combines labor and capital to produce goods and services.

China And The Global Technology Frontier

The pace of China's catch-up will be determined by how fast it closes two productivity gaps (7). The first gap is between China's advanced industries in its coastal regions and the global technology frontier. This relies, in part, on importing foreign technology through trade and investment and this is where U.S. pressure could be felt. The second gap is between China's poorer interior and its richer eastern coast. This internal gap relies less on new technology because these regions could still benefit from moving into activities already being performed by their richer east coast peers. Improving resource allocation by moving more productive capital to the interior, where their marginal returns are higher, will be more important.

While both productivity gaps can help China sustain growth rates well above those of rich countries for some time, only by closing the external gap, by definition, will the Chinese catch-up endure. Internal convergence will eventually peter out even if China achieves what few other countries have achieved in eliminating regional inequality. This will leave technology-driven productivity growth as the only remaining driver of long term potential growth. In other words, reforms that improve resource allocation across provinces are necessary but will not be sufficient to sustain catch-up if China cannot boost long run productivity by accessing foreign technology.

Optimists may argue that not only has China's external technology gap all but disappeared but that China has the capacity to innovate and shift its technology frontier quicker than rich countries. Their arguments are now well known and include a large population of STEM (science, technology, engineering, and math) graduates, abundant data (the fuel for machine learning), and state support. We remain cautious about these arguments.

China Has Become a Technology Power in its Own Right…

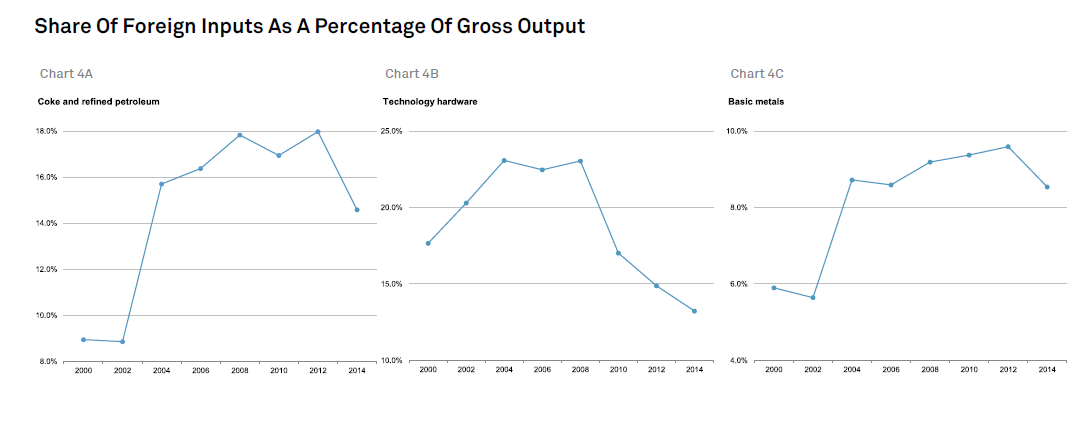

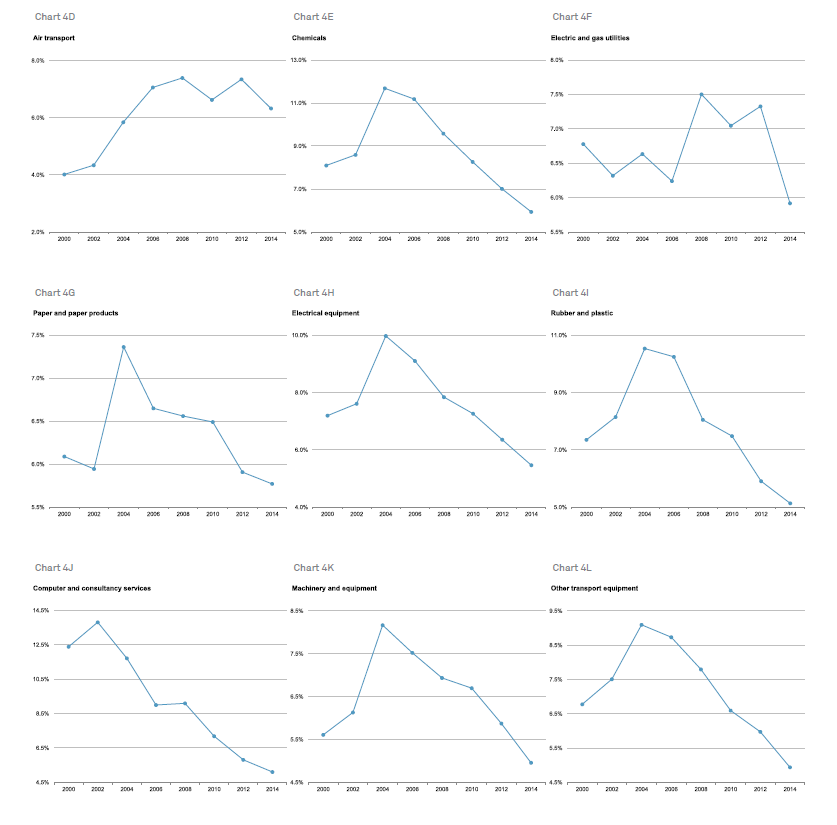

China has progressed from being merely a hub for processing trade—putting together high-value components made elsewhere—to a technology producer in its own right. We can see this in the rising domestic share of value-added in high-growth sectors using input-output tables. Between 2008 and 2014 (the latest data available), China's own domestic contribution to total output in the technology hardware sector rose about 10ppts to almost 90% (some estimates put it much lower than this). Since then, it is likely to have edged higher. A rising domestic share of value-added is evident in other high-growth sectors such as electrical equipment but also technology services.

Share Of Foreign Inputs As A Percentage Of Gross Output

Source: World Input-Output Database of the University of Groningen and S&P Global Economics.

China's success in climbing the value-added chain reflects, in part, its own efforts in improving human capital and creating fertile ground for innovation and learning, especially in industries without a large SOE footprint. However, China has also benefitted from the presence of increasingly complex supply chains related to technology goods and services. World Bank research suggests that "contractual linkages," the relationships between foreign firms and local suppliers, are particularly effective in transferring knowledge and practices to the domestic economy (8). Over time, Chinese firms have upgraded their products to the point where they can plug into technology supply chains.

…But Still Relies Heavily on Foreign Technology

While China has reduced the dollar share of foreign inputs into its high-growth sectors, it may be harder to displace the remaining foreign inputs and shift the technology frontier on its own, at least in the short to medium term. While China has become a leader in commercially applying technology in some sectors—famously including payments and e-commerce—there are many others where it continues to rely on foreign inputs in the form of hardware and, through overseas education, human capital. Even in Artificial Intelligence (AI), an area where China may have a competitive edge, further rapid progress will depend on foreign technology, especially advanced semiconductors needed to process vast amounts of data (9).

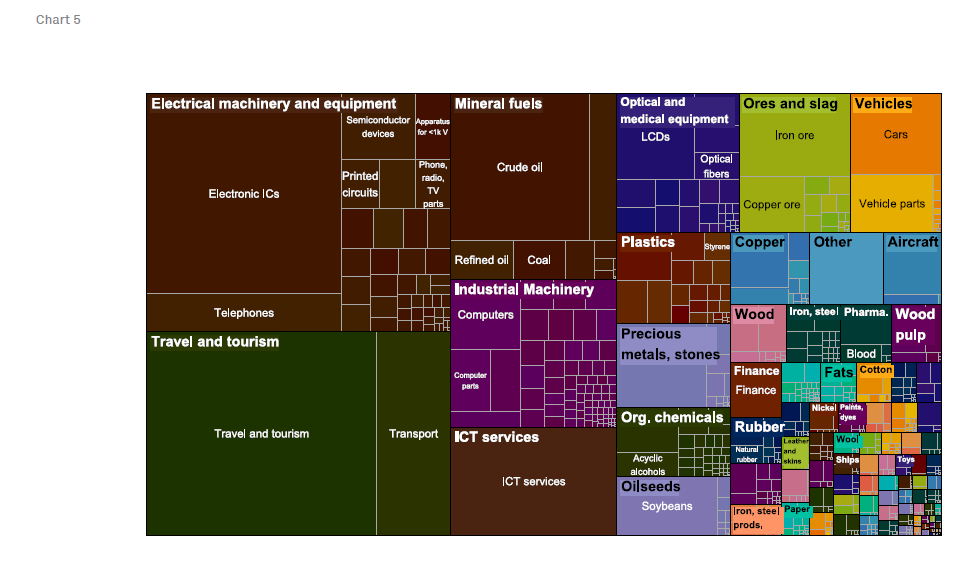

China's import basket (including both merchandise and services trade) reveals this reliance on foreign technology. China's largest goods import by value is semiconductors accounting for over 12% of total imports, a broadly similar share to that in 2006 (10). Semiconductor imports are about twice as large as those of crude oil.

Source: Harvard World Trade Atlas and S&P Global Economics.

At the same time, China exports very little of its own semiconductors resulting in net imports of about US$161 billion (or 1.25% of GDP) in 2017.

A Granular Look At China's Tech Supply Chain

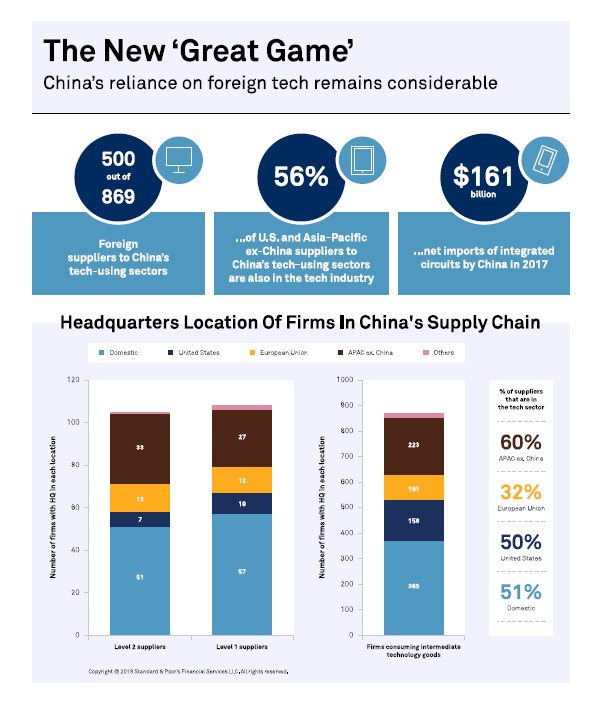

Trade data do not always provide the full picture especially when supply chains are complex and hop across multiple international borders and when multinational firms massage transfer prices to minimize taxes. To provide more insight, we identified supplier relationships at the firm level using the S&P Global Market Intelligence database. This is helpful because we can identify the origin of the supplier based on the location of their headquarters even if shipments come from offshore subsidiaries.

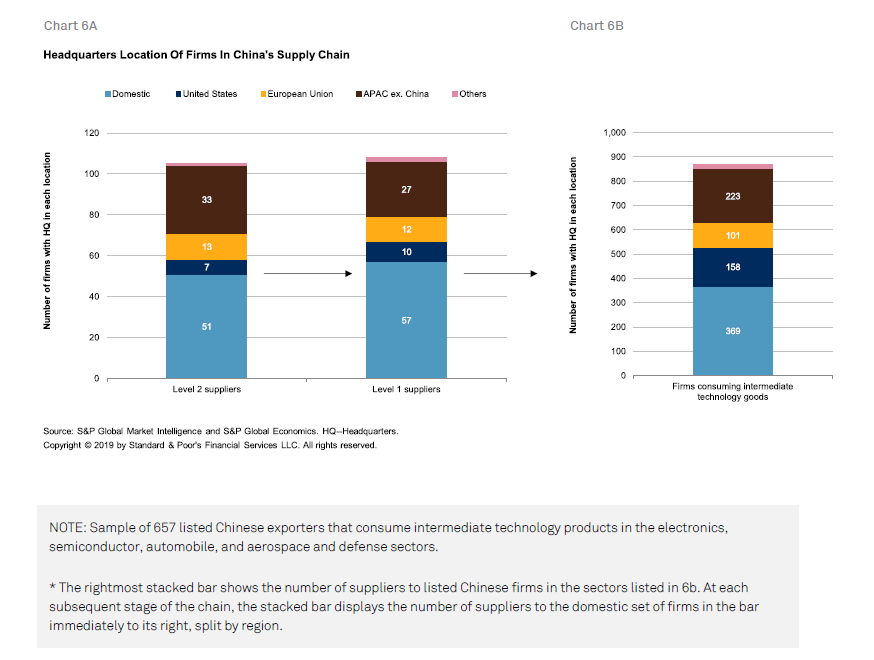

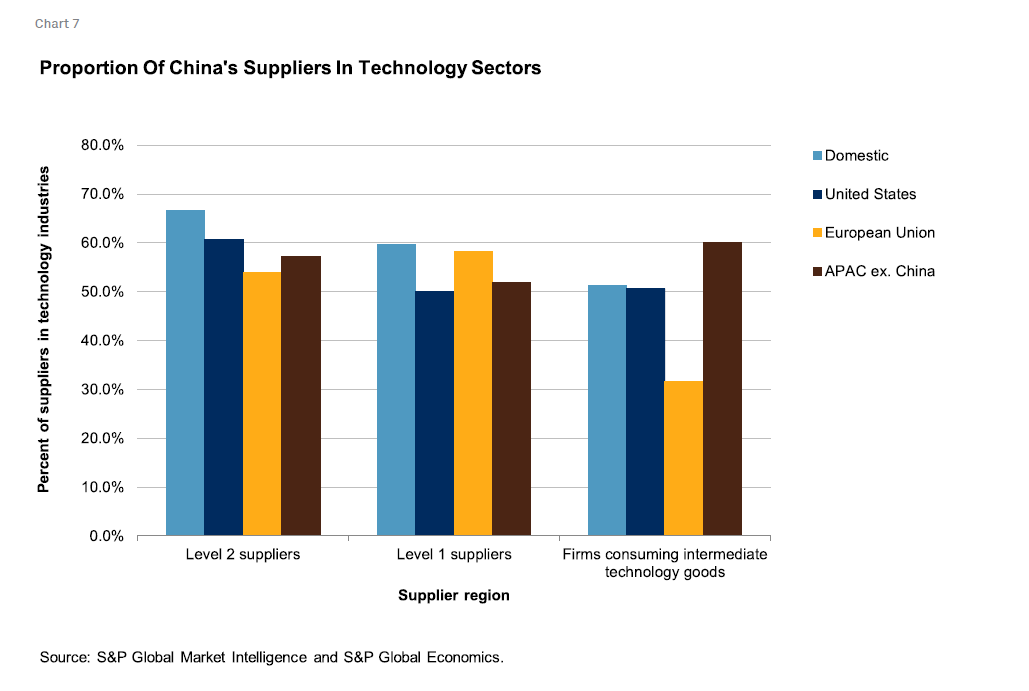

We restrict our sample to 657 listed Chinese exporters in sectors which consume intermediate technology products: electronics, semiconductors, automobiles, and aerospace and defense. Our data are limited to counting only the number of suppliers instead of the dollar value of inputs, but some clear patterns emerge.

First, foreign suppliers are deeply embedded in China's technology supply chain. Chart 6 shows the suppliers of the technology consuming firms but then goes back another two links in the chain starting at the suppliers of the domestic suppliers. At the last stage of the chain, we found around 500 foreign suppliers, most of whom are headquartered in Asia-Pacific or the U.S.

Turning the focus to the sectors of these suppliers in Chart 7, we find that about half of the suppliers from Asia-Pacific and the U.S. are in technology. This suggests Asian and U.S. firms are especially important in providing the intellectual-property-rich technology inputs into China's supply chain.

NOTE: Sample of 657 listed Chinese firms that consume intermediate technology products in the electronics, semiconductor, automobile, and aerospace and defense sectors.

FDI Flows Show China's Hunger For New Technology

One way China (in common with many developing countries) has improved its access to technology is through foreign direct investment (FDI). From a Chinese perspective this is a passive role. Foreign firms make most decisions about what and when to invest and, in theory if not always in practice, retain control of the intellectual property. The beneficial spillovers to the recipient country, such as training of local staff and the organic growth of supply-chain ecosystems, are often slow and incomplete. In some cases, the foreign firm will continue to import many of the high value-added components.

Unlike many developing countries, China was never satisfied with this "passive recipient" model. Instead, China encouraged and in some cases forced foreign firms to share technology through joint ventures. As long ago as the 1980s, China offered foreign firms a deal that few other countries could—trade your technology for access to our market (11). Whether or not this classifies as "forced" technology transfer (and a recent State Council white paper argued it does not [12]) this practice has contributed to the current backlash among some of China's G20 peers. However, for many global companies, the trade until recently has been worth it, providing foreign brands with remarkable revenue growth from the Chinese market and access to a highly competitive manufacturing base.

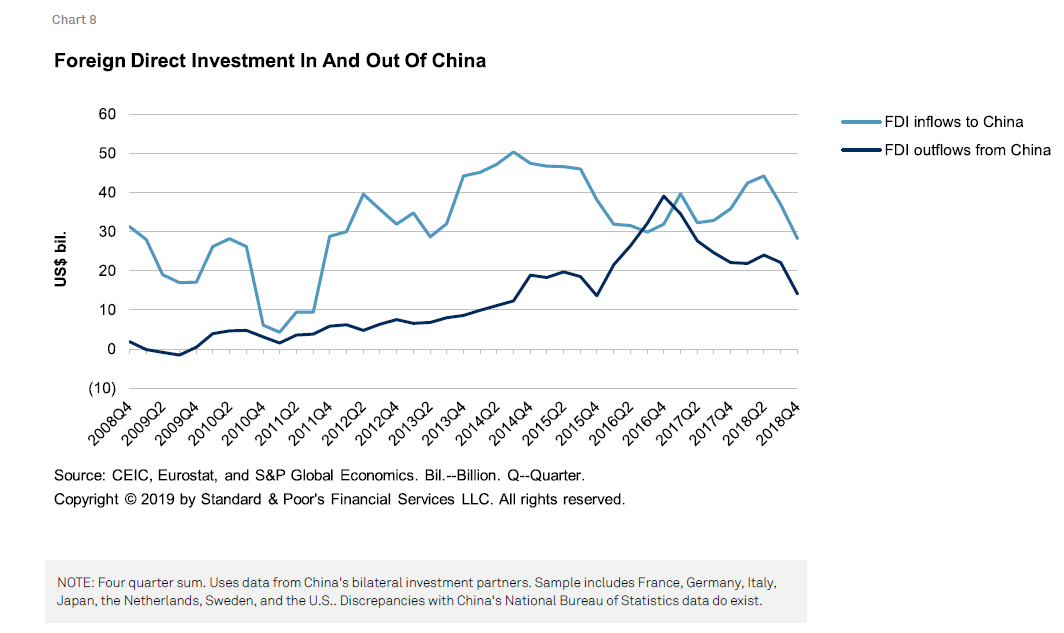

China has updated its strategy and is now scouring the planet in search of technology it does not yet have but wants to acquire quickly. Chinese firms are now trying to acquire large or controlling stakes in foreign businesses that own valuable technology IP. When successful, these acquisitions are recorded as foreign direct investment and a changed direction of net FDI flows hint at this strategic shift. FDI is difficult to measure accurately but the official data suggest that outbound Chinese FDI into rich economies had begun to rise very quickly.

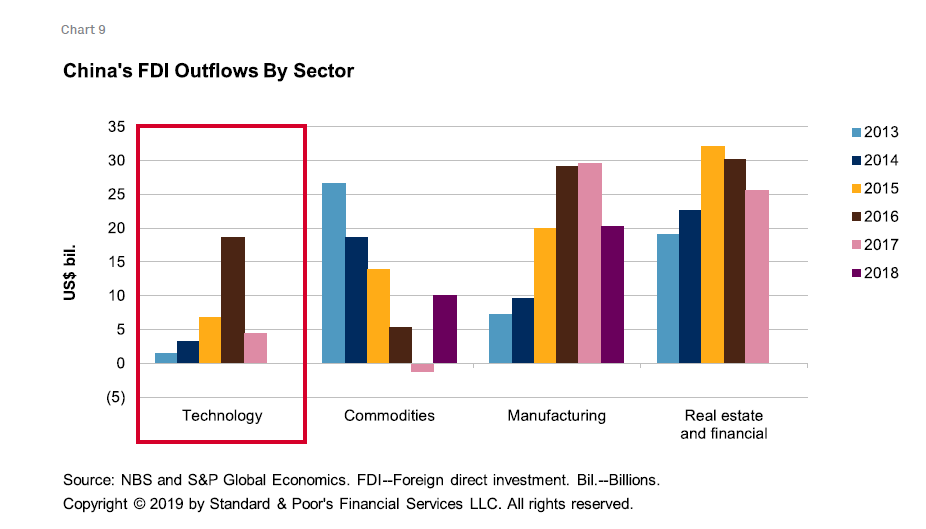

Since 2016, China's FDI outflows have plummeted. We calculate that for a sample of six advanced economies, including Germany, Japan, and the U.S., rolling four-quarter FDI from China fell by two-thirds from the near US$40 billion peak by the end of 2018. In part this reflects greater domestic controls on outflows and discouraged investments (such as "trophy" real estate) to ease pressure on the exchange rate (13). More scrutiny by the U.S. and other countries of Chinese investment has also played a role.

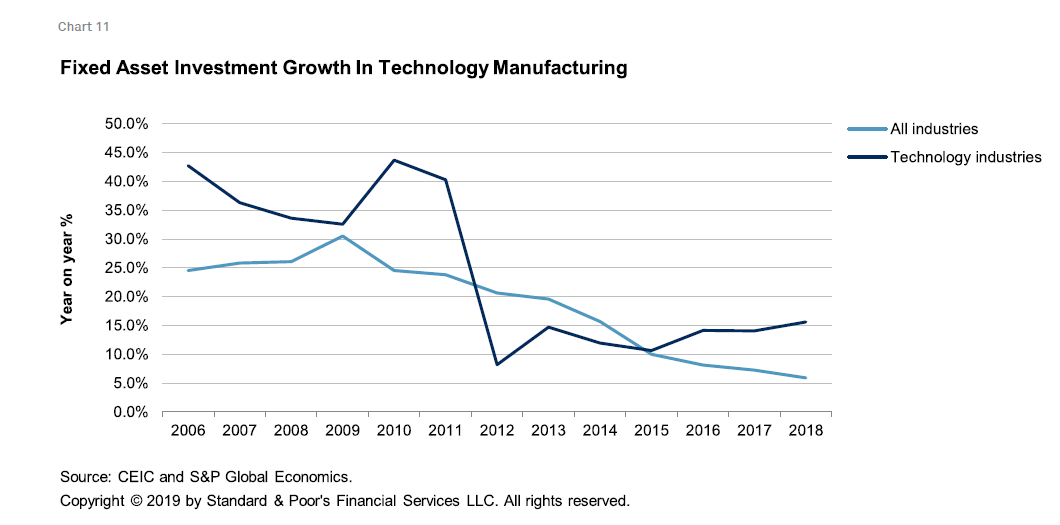

Technology FDI outflows to rich countries have seen the largest rise and fall in recent years. Perhaps not coincidentally, soon after the formal release of the "Made in China 2025" plan in 2015, technology FDI began to surge higher, almost tripling in 2016. Since then, technology FDI has slowed to almost a trickle. China's statistics agency has not yet released the full 2018 FDI outflow data by sector. Still, we do know that FDI in manufacturing--a sector in which China is seeking to move to the technology frontier--declined by more than 30%. Strategically less important outflows into foreign real estate remain high. Of course, this is a sector less subject to scrutiny by the recipient countries.

Equity Markets Reflect The Tech Focus

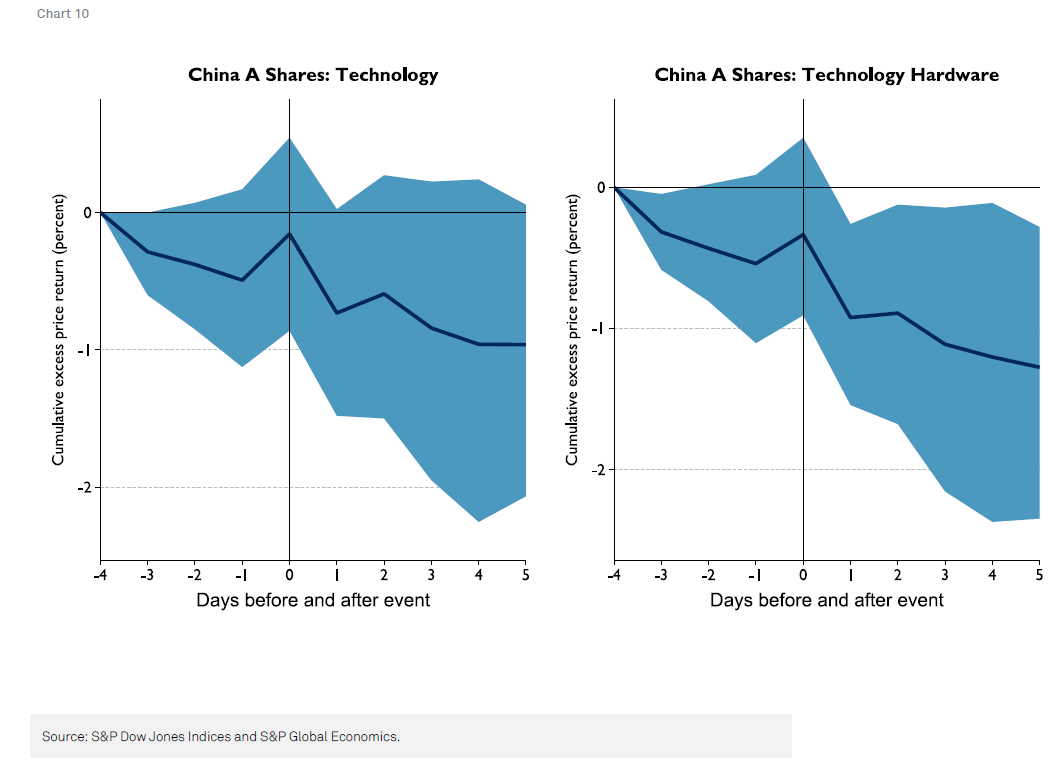

China's equity market investors appear to share our view that the technology sector is most vulnerable to U.S. trade and investment policies. We looked at the performance of onshore listed technology shares shortly before and after news related to U.S-China frictions. We excluded events that were widely expected, such as the implementation of previously announced tariffs, and focused on events that brought new information to the market (see table 1).

The results indicate that technology shares declined heavily after news related to U.S.-China friction--even more so than would normally be expected for this highly volatile sector (14). Following news, technology shares fell by an average of 1% while tech hardware shares fell even more, by 1.5%.

Why China's New Growth Model Goes Beyond Demand Rebalancing

Up to now, we have not mentioned the other dimension of China's new growth model—a more consumption-driven economy. We do not downplay demand rebalancing because it remains necessary for China to navigate to a safer path for growth, one that is consistent with an eventual stabilization of debt to GDP and reduced financial sector risks.

However, demand rebalancing without higher productivity growth will leave China struggling to sustain catch-up with rich economies. Consumption growth can stay high during a transition period in which the household share of national income rises, savings decline, and household leverage edges higher. Beyond this period, though, household spending will be determined mainly by real wage growth which, in turn, can only be delivered by productivity growth. In other words, China needs to create more new jobs in increasingly well-paid, high value added growth sectors. This will need increasing amounts of sophisticated, high-return capital stock, including intangibles such as software.

Expect U.S.-China Frictions To Persist

"Internationally, advanced technology and key technologies are becoming more and more difficult to obtain. Unilateralism and trade protectionism are rising, forcing us to take the road of self-reliance. This is not a bad thing. China ultimately depends on itself." -- President Xi Jinping, Heilongjiang Province, September 2018.

On economic issues, the current gap between China and the U.S. (and other countries) seems wide. It also seems unlikely that China's leaders will drastically change the direction of strategic economic policy so soon after last year's 19th Party Congress. In fact, efforts to achieve the targets set out in the roadmap, especially domestic self-reliance in key growth sectors, may even be redoubled as a reaction to recent difficulties some Chinese firms have in accessing foreign technology.

Our baseline assumes continued but gradual and targeted opening up of China's economy. Over the last 12 months, China has committed to widen foreign access to key sectors, including the financial sector and autos. Foreign firms are also competing with domestic firms in some high growth areas such as the provision of (some) cloud computing services and have benefitted from improved access in pharmaceuticals. However, a dramatic acceleration appears highly unlikely.

U.S.-China Friction--Effects Likely Overestimated In The Short Run…

The direct short-run demand hit to China's growth from friction with the U.S. is likely to be manageable. The tariff hit is small because the share of U.S. exports in China's GDP is less than 4%, a number which falls even further when we measure it as added value (netting out imported inputs). It's hard to move China's macro needle much on bilateral trade with the U.S. and any effects could be offset by a combination of moderate currency depreciation, trade diversion, and fiscal stimulus.

The impact of investment restrictions, export controls, and tariffs on investment is the key uncertainty. If firms are less certain about whether they will be able to access key technologies in the future, whether in terms of new capital or intermediate inputs, they are likely to delay or even cancel their capital expenditures. The S&P baseline assumes some delay of investment will happen but only gradually over time. For now, there is only weak evidence that investment has been affected by U.S.-China tensions.

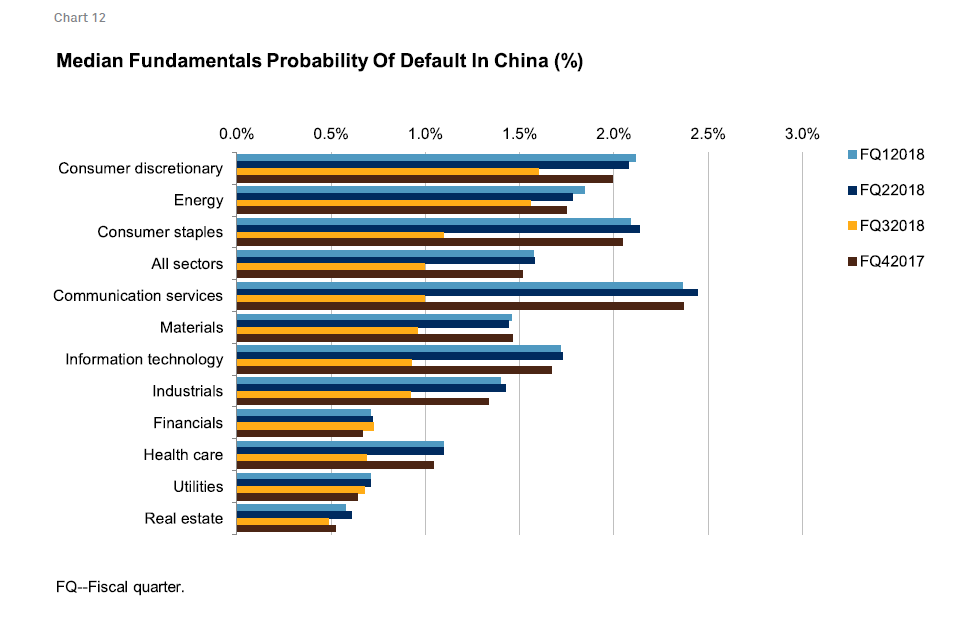

The credit implications of U.S.-China friction, are also limited in the short run. The pain would be felt first in those sectors directly affected. The equity market is already telling us this will be mainly technology but also other intermediate and capital goods producers. The good news for China is, like in other economies, its technology sector tends to be asset-light and mostly financed by equity rather than debt. This is reflected in median fundamentals probability of defaults that are lower than more highly indebted sectors (see chart 12). The direct exposure of China's credit markets and financial system to stress in the technology and light manufacturing sector is low. At least in the short term, this is mainly a growth rather than a financial stability problem.

…Effects Likely Underestimated In The Long Run

Our key argument is that persistent U.S.-China friction would slow technology transfer and substantially lower China's sustainable rate of medium term growth—perhaps a growth rate closer to or below 4% than 5% on average over the 2020s. This would then imply two scenarios. First, China accepts this lower growth rate and redoubles efforts to push through difficult reforms to lift productivity but which pay off only in the long run. These reforms would be a combination of further, gradual opening up but also measures to encourage innovation and homegrown technology. This is consistent with ongoing catch-up to rich economies, albeit at a slower pace.

Risk Scenario—China Responds To Slower Growth With Stimulus

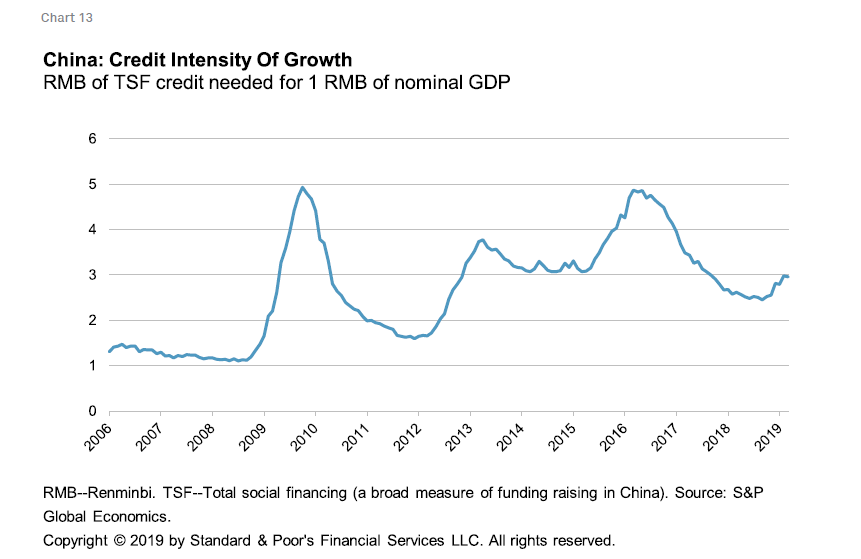

A second scenario is that Chinese policymakers resist this inevitable slowdown and prop up growth through excessively loose policies. This would mean a persistently high investment rate and capital continuing to be misallocated in low return activities. The result would be a persistently high credit intensity of growth—in other words, the amount of credit in Chinese renminbi (RMB) needed to deliver 1 RMB of nominal GDP would stay high, perhaps rising back above 3.

Credit intensity is a key variable to track for two reasons. First, it helps us assess the efficiency of investment because the marginal return on capital is hard to measure. Second, it provides a guide as to the eventual steady-state debt-GDP level. If credit intensity averages 3, then over time, the debt-to-GDP level (defined here as the ratio of nonfinancial private sector plus local government bonds to GDP) will converge to about 300%.

Reasons For Optimism And Caution

While S&P Global Economics believe that the nature and long-term impact of U.S-China friction is perhaps underappreciated, we are also not too gloomy about the outlook. Our baseline assumes that the U.S. and China will, gradually over time, resolve their major differences because it is in the self-interest of both countries to do so. We also assume that China has the capacity to continue to innovate, converge to rich economies (albeit at a slower rate), and avoid a crisis over the medium term. At the same time, the risks facing China have risen over the last 12 months and success is far from guaranteed.

(1) Federal Register, Vol. 83, No. 197, Thursday, Oct. 11, 2018, Rules and Regulations.

(2) https://www.regulations.gov/docket?D=BIS-2018-0024

(3) "China's Fujian drops Aixtron bid after Obama blocks deal," Reuters, Dec. 8, 2016.

(4) Estimates from Dealreporter, July 2018.

(5) Estimates from the Pillsbury Winthrop Shaw Pittman LLP Fall 2018 CFIUS White Paper.

(6) "China's New Economy Grows Twice as Fast as GDP and Helps Offset Job Losses, Says Top Think Tank," South China Morning Post, December, 2017

(7) Jefferson, Gary H, Albert G. Zhu, and Jian Su, The Sources and Sustainability of China's Economic Growth, Brookings, 2006.

(8) Reyes, José-Daniel, "FDI Spillovers and High-Growth Firms in Developing Countries," World Bank Policy Research Working Paper 8243, 2017.

(9) Yinug, Falan, "Semiconductors: A Strategic U.S. Advantage in the Global Artificial Intelligence Technology Race," Semiconductor Industry Association, 2018.

(10) Measured in U.S. dollars and defined by at the HS 4-digit level (electronic integrate circuits, HS8542).

(11) Yahuda, Michael. "Deng Xiaoping: The Statesman," China Quarterly, no. 135, 1993, pp. 551–572.

(12) The Facts and China's Position on China-US Trade Friction, Information Office of the State Council, The People's Republic of China, September 2018.

(13) Opinions on Further Guiding and Regulating Outbound Investment, Circular of the General Office of the State Council No. 74, August 2017

(14) Note: We adjusted the reaction of technology share prices to account for the their typically high volatility--in other words, we used the excess price change over and above what would be expected given the performance of the overall A-share index.

The S&P Global China Senior Analyst Group is sponsored by the APAC Leadership Council. Its members are, in alphabetical order: Paul Bartholomew (Platts), Terry Chan (Ratings), Michelle Cheong (MI), Vincent Conti (Ratings), Paul Gruenwald (Ratings), Jian Huang (Market Intelligence), Christopher Lee (Ratings), Sebastian Lewis (Platts), Priscilla Luk (Indices), Shaun Roache (Ratings), KimEng Tan (Ratings), Ryan Tsang (Ratings), Zhuwei Wang (Platts), and Christopher Yip (Ratings).

This report does not constitute a rating action.