Join S&P Global for a comprehensive analysis of varying Russia/Ukraine conflict scenarios during a period of economic uncertainty. Paul Gruenwald, Global Chief Economist, S&P Global Ratings will outline key macroeconomic observations and the possible paths the conflict could take.

ACCESS THE REPLAYEurope’s Energy Supply

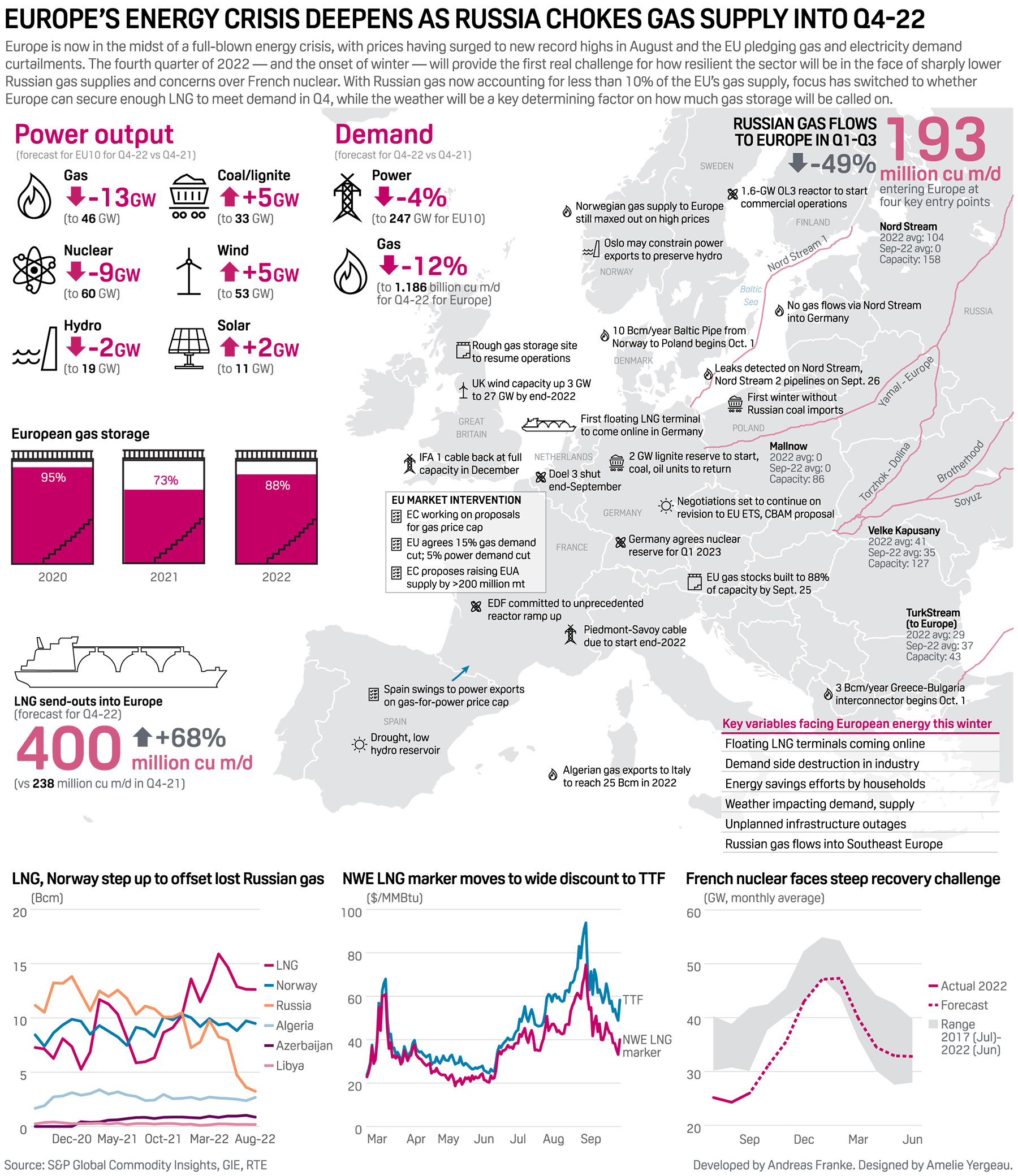

Europe's Energy Crisis Deepens as Russia Chokes Gas Supply into Q4

Europe is now in the midst of a full-blown energy crisis, with prices having surged to new record highs in August and the EU pledging gas and electricity demand curtailments.

Complications for European Marine Fuel as Russian Middle Distillate Imports Fall

Reduced European imports of Russian middle distillates has been leading to complications in marine fuel, with a leading testing agency seeing rising demand for lubricity tests to ensure fuel will not damage engines.

Read the ArticleEnergy in the New Era

This report, published to coincide with S&P Global Commodity Insights’ APPEC 2022 event, explores the interplay between energy transition and energy security, ranging over topics from oil and refining to carbon markets, sustainable shipping and hydrogen.

Read the ArticleU.K. Utility Services Provider Fulcrum Alerts Market to Cyber Incident

U.K. multi-utility infrastructure and services provider Fulcrum notified the market Sept. 27 of a cyber security incident on its network after detecting unauthorized activity.

Read the ArticleReceive immediate insights on the individual market developments you need to know for a 360° perspective on the big stories shaping our world.

SUBSCRIBE TO OUR NEWSLETTERSFinancial Market Pressures

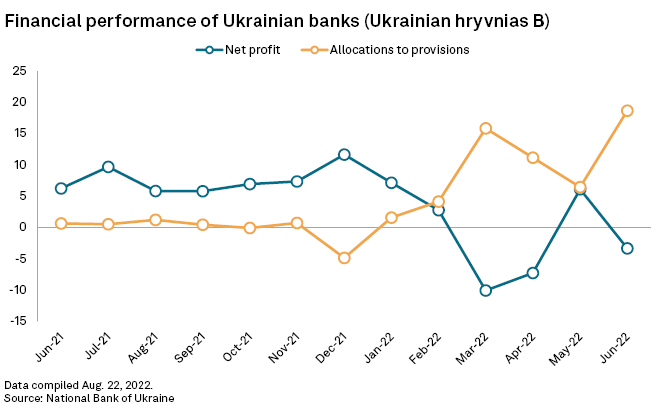

Ukrainian Banks' Profits Crushed by War-Related Loan Loss Provisions

Losses in the Ukrainian banking industry deepened in the second quarter as lenders ramped up provisions for bad loans, a trend that the country's central bank expects to continue amid the war with Russia.

Banks in Ukraine posted an aggregate net loss of 4.5 billion hryvnia in the second quarter, pushing the first half losses to 4.6 billion hryvnia, the National Bank of Ukraine said. Provisions for losses expected due to the war reached 57.9 billion hryvnia at June-end, of which 52.1 billion hryvnia was allocated in the second quarter.

JSC KREDOBANK, the systemically important local unit of Poland-based PKO Bank Polski SA, posted a net profit of 2 million zlotys for the second quarter. Its aggregated net profit of 8 million zlotys for the first half of 2022 was down 86% year over year.

Foreign Banks Reap Higher Profits From Russian Units As Putin Closes Exit Route

For foreign banks still contemplating the future of their Russian operations, President Vladimir Putin's decree banning the disposal of such businesses has complicated matters. There is a silver lining: These subsidiaries are increasingly profitable.

Read the ArticleAustria's RBI Keeps Russian Unit Options Open as Strong Ruble Drives Q2 Earnings

Raiffeisen Bank International AG is still weighing up the options for its Russian business and has not yet set a deadline for a final decision, CEO Johann Strobl said.

Read the ArticleBanks Face Growing Regulatory Scrutiny Over Russia Export Control Violations

Regulators are raising expectations for banks' compliance programs amid concerns that lenders could be breaching U.S. export controls by financing the trade of equipment for military use in Russia through intermediary countries.

Read the ArticleThe Russian invasion of Ukraine has not only initiated a global humanitarian crisis, it’s given rise to greater risk exposures in capital flows, trade and commodity markets worldwide. Our experts are sensitive to the effect of the conflict on global economies as well as its impact on our community in deep and varied ways.

READ MOREChina's Evolving Role

China (Mainland) May Move to Limit Impact of U.S. Financial Weapons

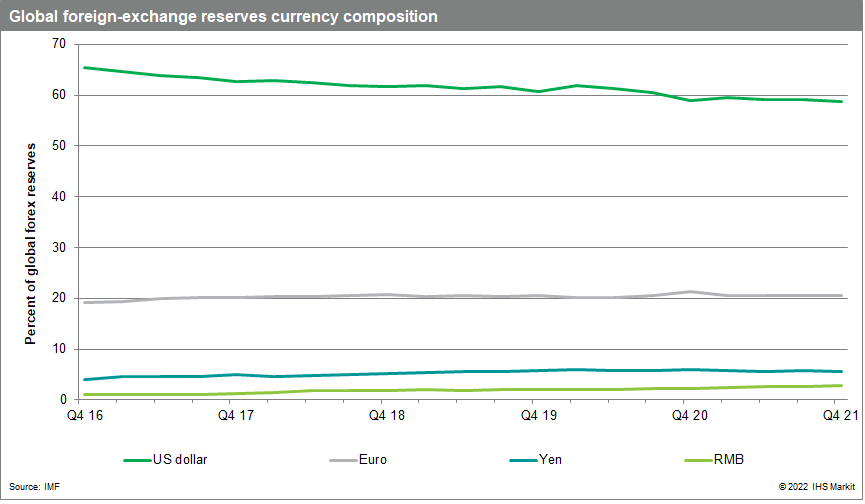

The weaponization of the US dollar against Russia after its invasion of Ukraine has raised expectations that Beijing will accelerate its de-dollarization efforts, to protect against similar financial sanctions that Washington could deploy against China (mainland).

While the Chinese renminbi (RMB) is unlikely to dethrone the US dollar in the global financial system soon, concerns remain that the dollar's weaponization against Russia has initiated an irreversible fracturing of the global financial system that will result in two international monetary systems, one led by the United States and one by China.

Markets Brace for Oil, Gas Demand Destruction as China Pursues Zero-COVID Policy

China's ongoing COVID crisis is one of the key events driving commodity markets.

View the InfographicKey China-Russia Oil and Gas Deals, Joint Projects and Energy Investments

Energy supply diversification to China has been at the core of Russia's eastern pivot, while Russian gas is central to China's energy diversification away from the Middle East and Australia.

READ THE FULL ARTICLELow-Priced Russian Urals Crude Cargoes Attract Chinese Buyers for June Deliveries

Several Chinese state-owned refiners have returned to the Russian spot market to buy May-loading Urals crude barrels, attracted by their record discount to Dated Brent, refining sources told S&P Global Commodity Insights March 22.

READ THE FULL ARTICLESanctions Against Russia

Sanctions on Russian Commodities Tracker

Russia's invasion of Ukraine triggered an unprecedented wave of sanctions against Moscow which are still rippling through global commodity markets.

In addition to official sanctions which continue to evolve, major self-sanctioning by industries looking to cut ties with Russia have deepened the market impact.

The Impact of Russia's Invasion of Ukraine: A Trade Finance Perspective- October Update

September and October witnessed significant new developments in the Russia/Ukraine conflict. The retreat of the Russian army from key towns and strategic locations in the Ukrainian east, the threat of nuclear weapon usage and the suspected sabotage of the Nord Stream 1 and 2 gas pipelines have all exacerbated tensions in the ongoing conflict.

Read the articleEU Agrees Latest Package of Sanctions Against Russia Including Chemical Export, Import Bans

The European Council has adopted the EU's eighth package of sanctions against Russia announced by the European Commission late September.

Read the ArticleNew EU Sanctions to Include Russian Semi-Finished Steel Imports

The European Council has adopted its eighth sanctions package against Russia for its invasion of Ukraine, which expands its ban on the import of Russian steel products to include semi-finished steel, the European Commission said in an Oct. 6 statement.

Read the ArticleIn response to Russia’s invasion of Ukraine, S&P Global Ratings continues to assess the effect on economies, markets, and credit.

ACCESS THE RESEARCHEffects on Oil

Asia's Appetite, Policy in Focus as World Set to Get Tougher on Russian Oil

Asia's appetite for discounted Russian oil is unlikely to ease soon as buyers scout around for attractively-priced barrels, but uncertainty surrounding EU trade policies as well as questions on China's appetite recovery will keep the markets guessing on volumes well into 2023, speakers and delegates at APPEC by S&P Global Commodity Insights said.

As Russia's recent declaration of a partial mobilization and plans for occupied areas of Ukraine to hold referenda on joining Russia have raised the risk that Western countries will introduce harsher sanctions, delegates said all eyes are on whether more Russian oil gets diverted to Asia.

Russian Seaborne Crude Exports Slide to 12-Month Low as EU Ban, Price Caps Loom

Russian seaborne crude exports fell to a 12-month low in September as European buyers continued to wind down purchases ahead of the introduction of sanctions, while surging flows into Turkey saw it become the third largest buyer of Moscow's oil behind China and India, according to tanker tracking data.

Read the articleOil Market Ponders Price Floor Amid Demand Destruction

Commodities show little sign of shaking the bearish momentum amid a slew of economic warnings across the globe. Whether the market wants to push oil much below $90/b amid potential OPEC output cuts, looming Russian sanctions, and the end of SPR releases is the big question. Demand destruction may be met by supply reduction.

Read the ArticleStress on Oil Markets to Factor into India's Position on Russia Oil Price Cap: Indian Official

Tight oil supplies and relatively high prices are weighing on India's ability to jump on board with US efforts to implement a global price cap on Russian crude, Indian External Affairs Minister Subrahmanyam Jaishankar said Sept. 27.

Read the ArticleAs the Russia-Ukraine military conflict rages on, S&P Global is continuing to assess the related effects on economies worldwide, the ramifications for financial and commodity markets, and the impact on borrowing conditions and credit quality.

Register NowImplications for Gas

Yuiry Vitrenko, Head of Ukraine's State-Owned Naftogaz, Resigns

Yuriy Vitrenko, the head of Ukraine's state-owned Naftogaz Ukrayiny, has resigned and will leave his post Nov. 3, a surprise move with significant implications for the country's gas sector.

In a statement, Naftogaz said Ukraine's Cabinet of Ministers accepted Vitrenko's resignation on Nov. 1.

"Vitrenko continues to hold his position as head of the national company until close of day Nov. 3. More detailed communication on this subject will be forthcoming on Vitrenko's last day of work as Naftogaz CEO," it said.

Vitrenko's surprise resignation comes as Ukraine faces what has been described as the most challenging winter in its history given low gas storage levels and ongoing Russian attacks on energy infrastructure.

Vitrenko had also played a key part in efforts by Naftogaz to prioritize domestic gas production to offset lost output in parts of the country occupied by Russian forces.

Ukraine currently has some 14.5 Bcm of gas in storage, well short of its target of 19 Bcm before the heating season, due to the high cost of gas imports.

European gas prices have been at sustained highs since September 2021 and surged to record highs in late August after sharp Russian gas supply curtailments.

Prices have, however, eased in recent weeks, and Ukraine has been importing additional gas volumes.

Russian Gas Flows to Europe Slide Further in October, Fall Below 2 Bcm

Russian gas flows to Europe slipped further in October, dropping below 2 Bcm for the month, an analysis of data from S&P Global Commodity Insights showed Nov. 2.

Read the articleRussia's Novak Casts Doubt on Europe's Ability to Meet Peak Winter Gas Demand

Russia's Deputy Prime Minister Alexander Novak cast doubt Oct. 13 on Europe's ability to meet peak winter gas demand without Russian supplies, saying the situation for the European market this winter was "critical."

Read the articleNorway Raises Emergency Level, Coordinating with Armed Forces Over Oil and Gas Drone Threat

Norway is coordinating with its armed forces, police, and oil and gas industry operators as it raises its "emergency preparedness" following sightings of unidentified drones near offshore oil and gas facilities in the North Sea, energy and petroleum minister Terje Aasland said Sept. 27 in an emailed statement.

Read the ArticleFollowing Russia's invasion of Ukraine, S&P Global Commodity Insights looks at the impacts on commodity and energy markets in the region and the world at large.

ACCESS THE TOPIC PAGEImpact on Metals & Chemicals

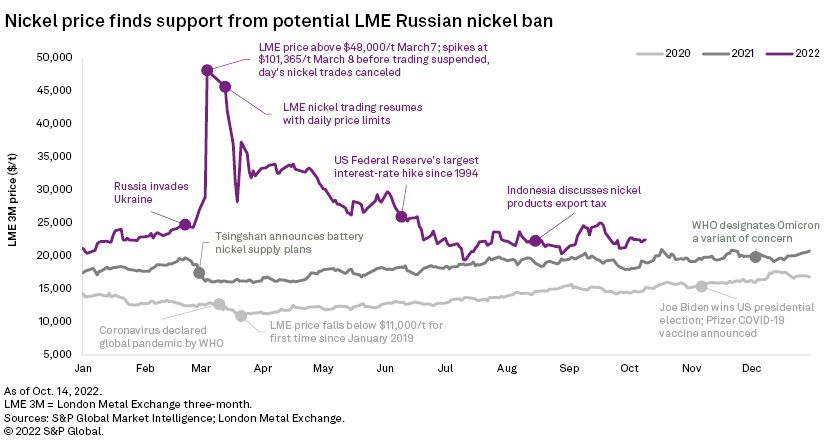

Nickel CBS October 2022 – Potential LME Russian Nickel Ban Supports Prices

S&P Global Commodity Insights discusses the nickel market within the broader macroeconomic environment and provides five-year supply, demand and price forecasts.

Key findings

The London Metal Exchange three-month, or LME 3M, nickel price closed September at $21,107 per tonne. The gains made earlier in the month were erased when prices fell following the U.S. Federal Reserve's Sept. 21 interest rate hike.

The price has closed above end-September levels, however, in every trading day in October to date on support from news that the LME is considering a total ban on new Russian nickel being delivered into its warehousing network.

Such a move could boost LME nickel prices, given that Russia is a major producer of LME-deliverable class 1 nickel.

Four Ukrainian Coal Mines Suspend Operations Late Oct 10 After Missile Strike

Four Ukrainian coal mines in Kryviy Rih suspended operations indefinitely on Oct. 10 following a Russian missile strike on the city, according to Oleksandr Vilkul, the head of the city's administration.

Read the articleLME's Plans to Address Russian Metal Trade Seen Supporting Chinese Aluminum: Sources

The London Metal Exchange's plan to restrict Russia-origin metal entering its warehouses could be a pivotal point for Chinese aluminum prices, combined with support from domestic production situation and output cuts, industry sources said Oct. 10.

Read the articleGeopolitics, Energy Costs, Shifting Trade Flows Put Italian Slab, Flat Steel Imports In Focus

Global geopolitics and economic sanctions have European steel rerollers looking for alternative sources of slab, forcing a persistent and long-term adjustment to trade flows that has decoupled the region from its traditional dependence on CIS area supply.

Read the ArticleAgriculture

Shrinking Corn Crop in EU Countries May Drive Higher Ukrainian Exports

Corn production in the European Union in the marketing year 2022-23 (July-June) is seen falling sharply due to prolonged drought in parts of the bloc, which is likely to open export opportunities for neighboring Ukraine.

Ukraine, for the past two years has been the largest corn exporter to the EU. This year, EU's corn imports have already reached three-year high levels and are likely to remain elevated for the rest of the year as domestic production is seen falling, sources said.

The US Department of Agriculture lowered EU corn production estimate in August to 60 million mt for MY 2022-23, down 15% on the year and 12% lower from the previous estimates. It is also below the five-year average for EU's corn production.

"The 8 million mt cut from is an interim step in our opinion, but it does acknowledge the severity of the situation in the EU," Platts Analytics said in a recent report. Platts Analytics sees EU corn production in MY 2022-23 to be in the range of 55 million-57 million mt.

Ukraine Sunflower Seed Prices Rise Amid Harvest Delay

Ukraine sunflower seed prices have risen by up to 11% since the beginning of September due to delays in the harvest and reluctance from farmers to sell.

Read the ArticleThe Russia-Ukraine War Is Reshaping The Fertilizer Industry

The effects of the Russia-Ukraine war may reverberate through the global fertilizer industry for years to come. Post-COVID supply-chain disruptions had already pushed fertilizer prices to cyclical highs in 2021.

Read the ArticleRussia Seeks Review of Ukraine's Black Sea Grain Exports Deal

Russian President Vladimir Putin Sept. 7 called for a review of the UN-brokered deal allowing Ukraine to export agricultural commodities from its Black Sea ports, triggering a spike in the price of corn and wheat futures.

Read the ArticleAs the Russia-Ukraine military conflict rages on, S&P Global Market Intelligence Insights reports on how geopolitical factors and market volatility issues are affecting businesses across all industries at the local, regional, and global levels.

ACCESS THE TOPIC PAGE