Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Is a Wall Street Recession Dragging on Economies?

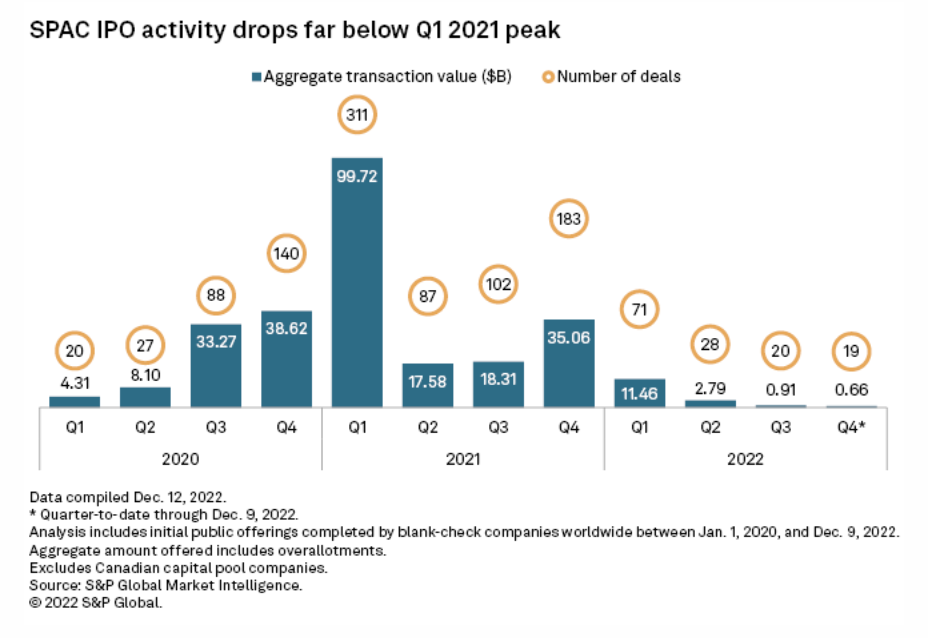

This year, global financial sectors will be “much darker” due to tougher economic conditions, according to S&P Global Ratings credit analyst Emmanuel Volland. This includes M&A and initial public offering activity.

At the end of September 2022, Porsche AG, which was part of Volkswagen AG, executed Europe’s largest IPO in over a decade with a $9.06 billion deal. Even with this successful offering, the total value of global IPO issuance was down 69.7% year over year when looking at the first nine months of 2022, according to data from S&P Global Market Intelligence.

A drop in issuance from special purpose acquisition companies also contributed to the decline of the total value of IPOs. Up to the third quarter of 2022, U.S. blank-check companies raised $10.48 billion, down from $120.30 billion through the same period in 2021. The drop in SPAC IPOs slows capital markets activity and reduces the pool for potential buyers.

In November 2022, financial activity contracted at the fastest pace since the COVID-19 pandemic began, according to the JPMorgan Global Composite PMI, compiled by S&P Global. Weaker confidence, the tightening of monetary policy conditions and greater market volatility appear to have been at the core of the wider financials downturn.

On Dec. 2, 2022, the Cboe Volatility Index — also known as the VIX and commonly called the stock market's fear gauge — settled below 20 for the first time since early October 2022. Traditionally there is an inverse relationship between the VIX, as a measure of options, and movement in the broader equity markets. However, this decline in the VIX reflected traders changing their hedging strategies and institutional investors shedding equities. It may also have been a sign that the S&P 500 reached its near-term peak.

"Despite this bleak outlook, we expect banks to show some resilience," said S&P Global Ratings’ Volland. "The main reason is that our base case assumes a shallow recession in some regions, rather than a full-blown recession."

Most global banks were in recovery mode in 2022 and have already enjoyed higher net interest margins. U.S. banks’ NIMs will likely expand further on higher rates after a 15%-20% rise in 2022.

Higher NIMs are good, but higher interest rates can also weigh on the value of bonds that banks own. Unrealized losses in banks’ securities portfolios accelerated in the third quarter of 2022. U.S. banks posted losses against what they described as “accumulated other comprehensive income,” or AOCI, of $771.39 billion for the first nine months of 2022, according to S&P Global Market Intelligence data.

According to Brett Rabatin, director of research at Hovde Group, "it does appear there's some correlation on valuations relative to the size of the AOCI mark on the balance sheet." While the loss in a securities portfolio may not be a broad issue, “it makes funding loan growth more challenging than it has been from a balance sheet perspective," Rabatin said.

If liquidity needs arise, lower-valued securities portfolios make the option of selling bonds far less appealing. Banks may delay or pause deployment of capital, reducing M&A activity further along with share repurchases.

Today is Thursday, January 5, 2023, and here is today’s essential intelligence.

Written by Ken Fredman.

Economy

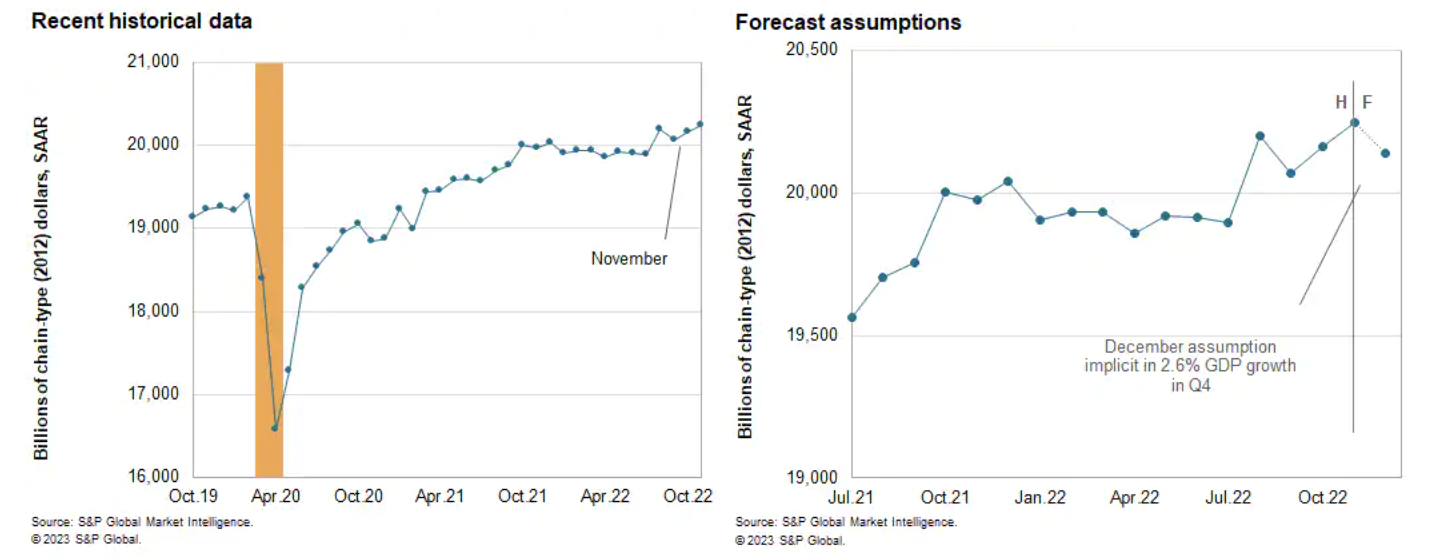

U.S. Monthly GDP Index For November 2022

Monthly GDP rose 0.4% in November following a 0.5% increase in October that was revised higher by 0.2 percentage point. The increase in November was more than accounted for by a sharp gain in net exports. Domestic final sales declined in November, mainly reflecting declines in residential and nonresidential fixed investment. Averaged over October and November, monthly GDP was 3.0% above the third-quarter average at an annual rate. Implicit in our latest estimate of 2.6% annualized GDP growth in the fourth quarter is a 0.5% decline (not annualized) in December.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

Capital Markets

Latin America In The Long Term: A Potential Application Of U.S. Equities

2022 was a challenging year for equity markets, as central banks around the world hiked interest rates in response to surging inflation. U.S. equities were affected by the souring sentiment, with the S&P Composite 1500 down 17.8% in 2022. More broadly, all 25 countries in the S&P Global Developed BMI declined in U.S. dollar terms since the end of 2021, while 15 out of 24 S&P Emerging BMI countries declined by the same measure.

—Read the article from S&P Dow Jones Indices

Access more insights on capital markets >

Global Trade

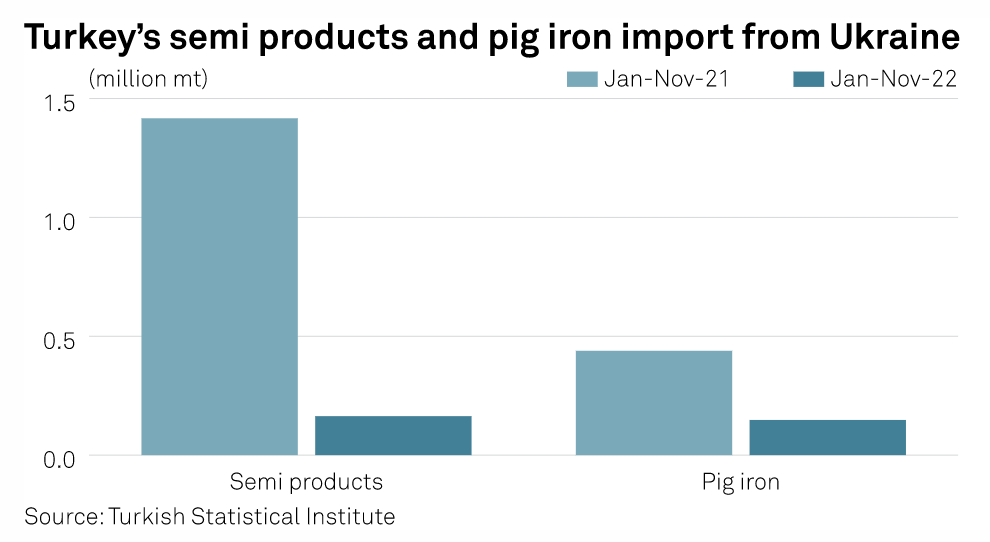

Russia Set To Dominate Black Sea Steel Market In Q1, Ukrainian Industry Crippled By War

With Ukraine's steel production infrastructure destroyed, idled or under Russian control, the Black Sea export market is unlikely to return to pre-war patterns any time soon and prices in the region will predominantly reflect Russian exports for the foreseeable future, market sources have told S&P Global Commodity Insights. Ukrainian steel exports to the spot market, although ongoing despite the devastating impact of Russia's invasion, have been significantly reduced in both volume and product range. But Black Sea ports remain unused by Ukrainian steel producers.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Sustainability

Energy Transition Investors Fighting To Defy SPAC Stigma

Once the hottest craze on Wall Street, special purpose acquisition companies have endured a fall from grace since the market peaked two years ago, but a few energy transition investors remain determined to succeed against the negative sentiment. Investors use SPACs, also known as blank-check companies, to bring privately owned, fast-growing startups into public markets. The energy transition space has been a key beneficiary of the trend, with companies involved in electric vehicles, nuclear technology and battery storage among those being targeted.

—Read the article from S&P Global Market Intelligence

Access more insights on sustainability

Energy & Commodities

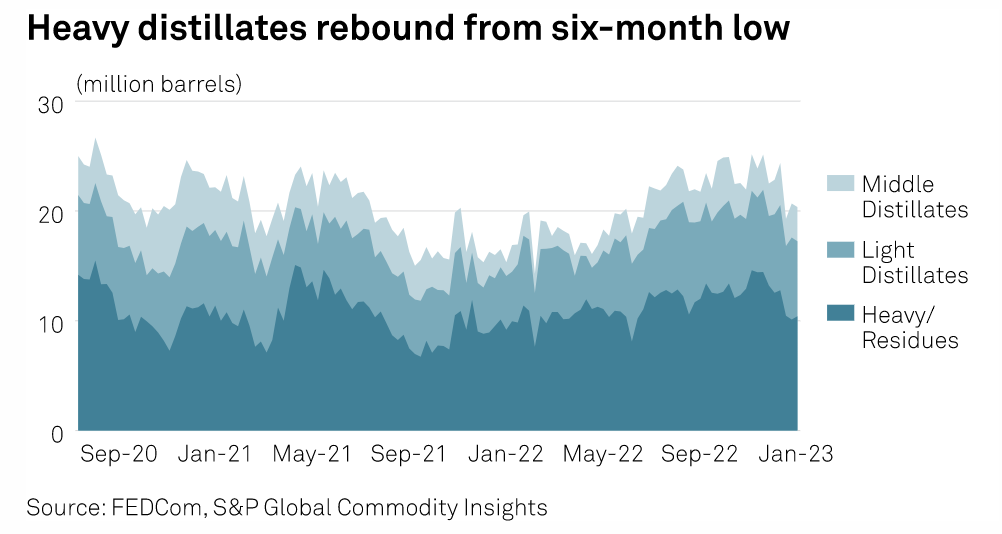

Fujairah Data: Oil Product Stockpiles Drop 1.5% After Second-Highest Annual Exports

Oil product stockpiles at the UAE's Port of Fujairah dropped 1.5% in the week ended Jan. 2, after exports for 2022 reached the second highest on record, according to Fujairah Oil Industry Zone and Kpler data. Total inventories were at 20.349 million barrels as of Jan. 2, a two-week low, the FOIZ data provided exclusively to S&P Global Commodities Insights on Jan. 4 showed. Product exports averaged 620,000 b/d in 2022, down 2.2% from the record 634,000 b/d set in 2021, according to Kpler data.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Technology & Media

Fintech Deals For Banks Still Make Sense Despite Scrutiny, Advisers Say

Previous efforts of fintechs buying banks are giving dealmakers greater clarity into how to navigate the regulatory approval process and whether the combinations are suitable for the parties involved. Bank regulators remain concerned about the potential risks that financial technology companies can pose when they increase their exposure to banking, and deals are not just getting a rubber stamp of approval. A prolonged approval process led to BM Technologies Inc. reconsidering its strategy and then terminating its deal for First Sound Bank in December 2022, a little more than a year after the companies announced the agreement.

—Read the article from S&P Global Market Intelligence