Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Credit Suisse Looks for a Path Forward

The year 2022 was supposed to see Credit Suisse recover from the challenges of 2021, but it was not to be. After another exacting year that saw the bank underperform while searching for a viable strategy, Chairman Axel Lehmann and CEO Ulrich Körner must hope that a fresh calendar will finally bring the much-anticipated turnaround.

Under the leadership of former Chairman António Horta-Osório in 2021, the bank’s share price underperformed its European peers by nearly 19%, due in part to the twin disasters of Archegos Capital and Greensill Capital. Hired in the hopes that he would repeat the success he achieved as CEO of U.K.-based Lloyds Banking Group PLC, Horta-Osório proved an uncomfortable fit for the staid culture of Swiss banking. After revelations that he had violated COVID-19 quarantine rules in Switzerland and the U.K., Horta-Osório departed the bank prematurely on Jan. 17, 2022, and was replaced by Axel Lehmann, former COO at crosstown rival UBS.

Credit Suisse’s recovery plan for 2023 looks a great deal like its plan for 2022: Namely, to drastically reduce its prime brokerage business and investment banking so it can focus on wealth management. However, the bank struggled to implement this strategy in 2022 due to executive turnover and challenging macroeconomic conditions. Halfway through the year, CEO Thomas Gottstein was replaced by Körner, occasioning a “comprehensive strategic review.” The bank had previously halved dividends following poor earnings.

S&P Global Market Intelligence cautioned that Credit Suisse was in danger of losing both investment banking and wealth management business due to the ongoing cultural and organizational upheaval. S&P Global Ratings lowered Credit Suisse Group's long-term issuer credit rating to BBB from BBB+ on May 16, 2022.

Despite the struggles of 2022, the bank insists it is taking the actions necessary to stabilize the franchise, reduce risk and focus on its core strengths in private banking and wealth management. It revealed plans to cut 17% of full-time jobs and sell billions of assets by 2025. Recently announced asset sales and continued strength in the domestic market have buoyed expectations that 2023 may be the year that Credit Suisse turns a corner.

Today is Monday, January 9, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

Economy

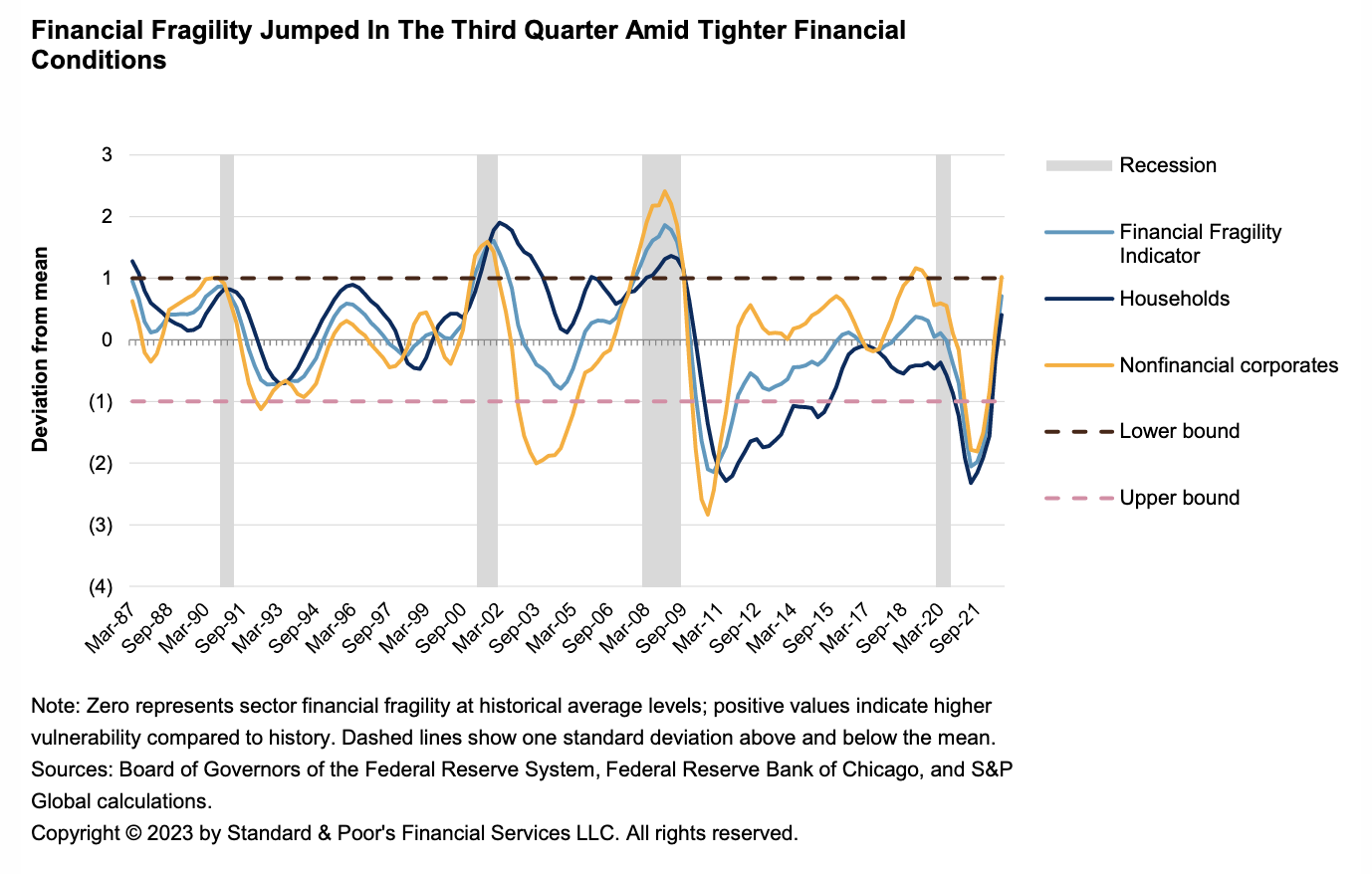

Economic Research: Financial Fragility Of U.S. Households And Businesses Rose In Third-Quarter 2022

The Financial Fragility Indicator (FFI) has worsened to its highest level since the global financial crisis, crossing the zero line — the historical average — in the third quarter, to 0.71 from -1.21 in first-quarter 2022. With aggressive policy normalization and a recession expected, financial conditions are likely to weaken further this year. For the U.S. nonfinancial corporate sector, the FFI jumped by more than 5x in the third quarter to 1.02 — over one standard deviation from its mean and its highest reading since second-quarter 2019. The increase in financial fragility was led by both higher leverage and liquidity risk, primarily as short-term debt increased and market value declined.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

Capital Markets

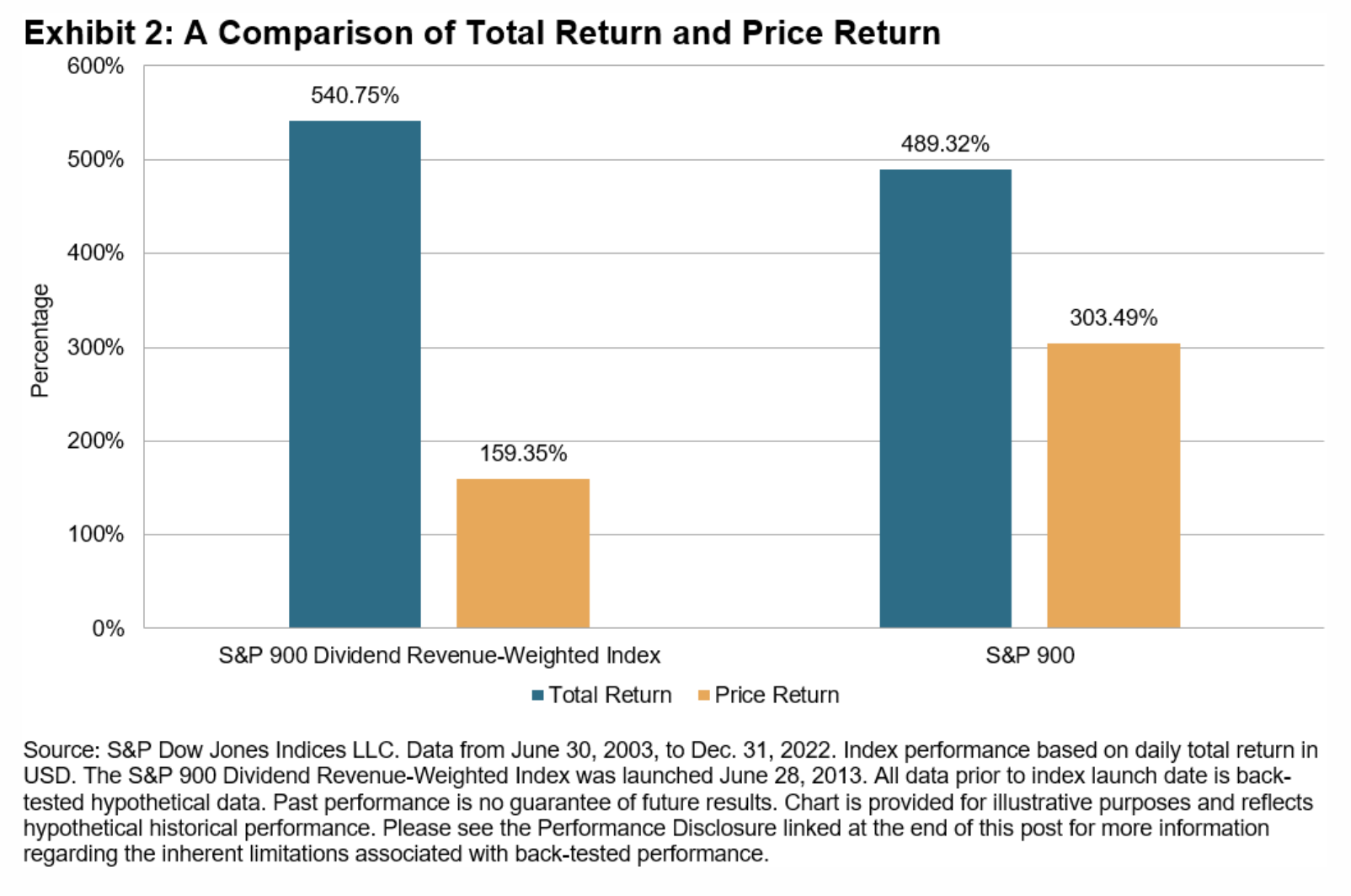

The S&P 900 Dividend Revenue-Weighted Index: A Standout Performer In A Challenging Year For Equity Markets

2022 was a difficult year for equity investors as rising interest rates, increasing geopolitical risks and slowing economic growth put downward pressure on equities. However, factors such as dividend yield and value fared much better than the broader equity market due to their shorter durations. Despite this challenging economic environment, the S&P 900 Dividend Revenue-Weighted Index posted an impressive 7.57% in 2022, representing 25.39% outperformance versus its benchmark.

—Read the article from S&P Dow Jones Indices

Access more insights on capital markets >

Global Trade

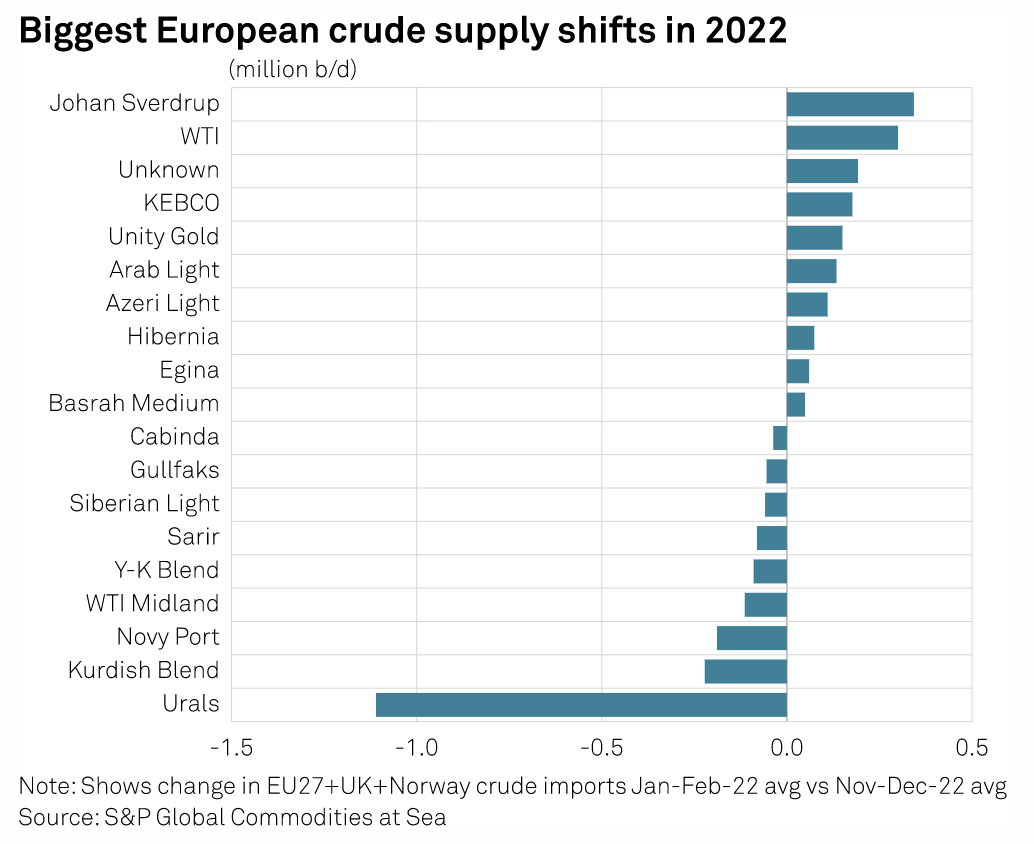

Europe Turns To Norway, U.S., Guyana, Saudi Crudes In 2022 To Fill Russian Supply Gap

European refiners turned to crude grades from Norway, the U.S., Saudi Arabia, Guyana and Azerbaijan in 2022 to plug the growing gap left by Russian imports sidelined by Western sanctions on Moscow, according to tanker tracking data. Russian seaborne crude imports into the EU, Norway and the U.K. shrank by 80% or 1.36 million b/d in November and December compared to pre-war levels of 1.71 million b/d, according to data from S&P Global Commodities at Sea. By far the biggest slide was in Russia's medium, sour Urals grade crude with smaller volumes of Novy Port and Siberian Light affected by a combination of self-sanctioning and the EU's embargo on seaborne crude from Russia.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Sustainability

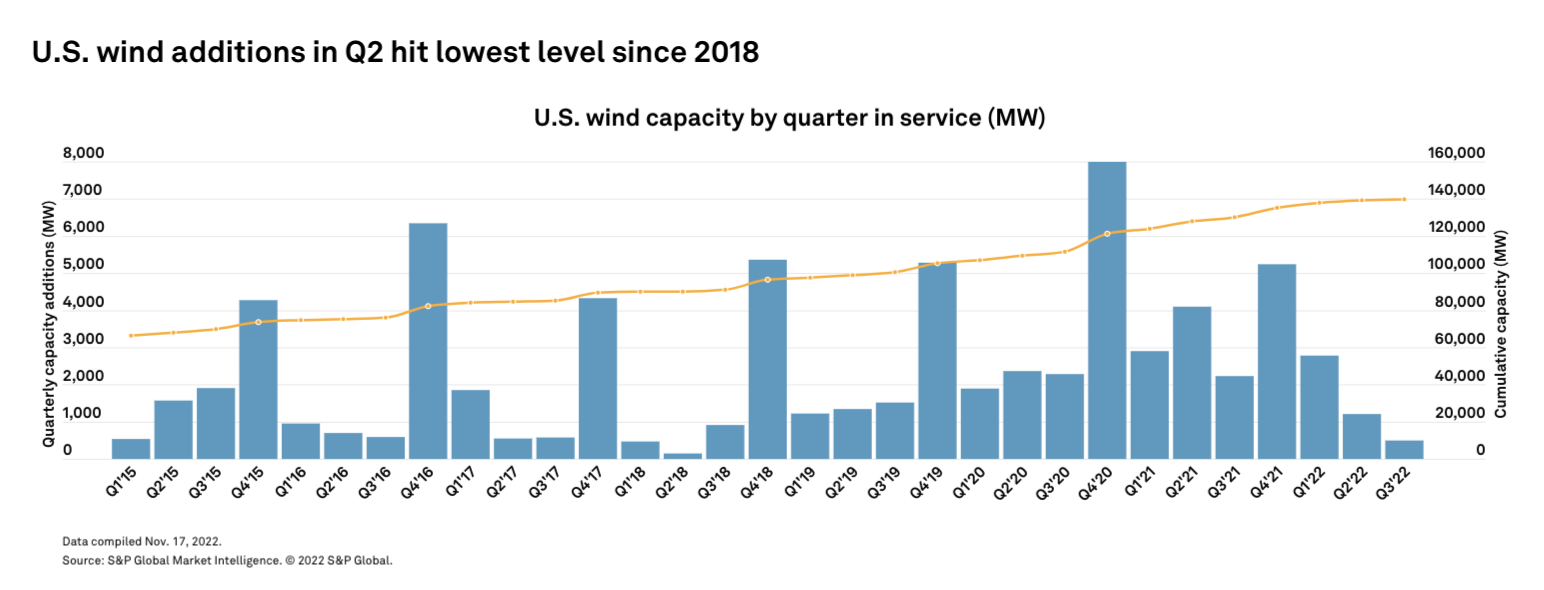

Infographic: U.S. Wind Power Q3 2022

U.S. developers added 501 MW of new wind power capacity from July to September, marking one of the slowest third quarters on record for project completion. The figure is 22% of the 2,227 MW of wind capacity energized in the third quarter of 2021. No other third quarter saw lower wind capacity additions since at least 2015. The 4,500 MW of new wind capacity added in the first three quarters of 2022 is less than half of that added by the end of 2021's third quarter, 9,223 MW.

—Read the article from S&P Global Market Intelligence

Access more insights on sustainability >

Energy & Commodities

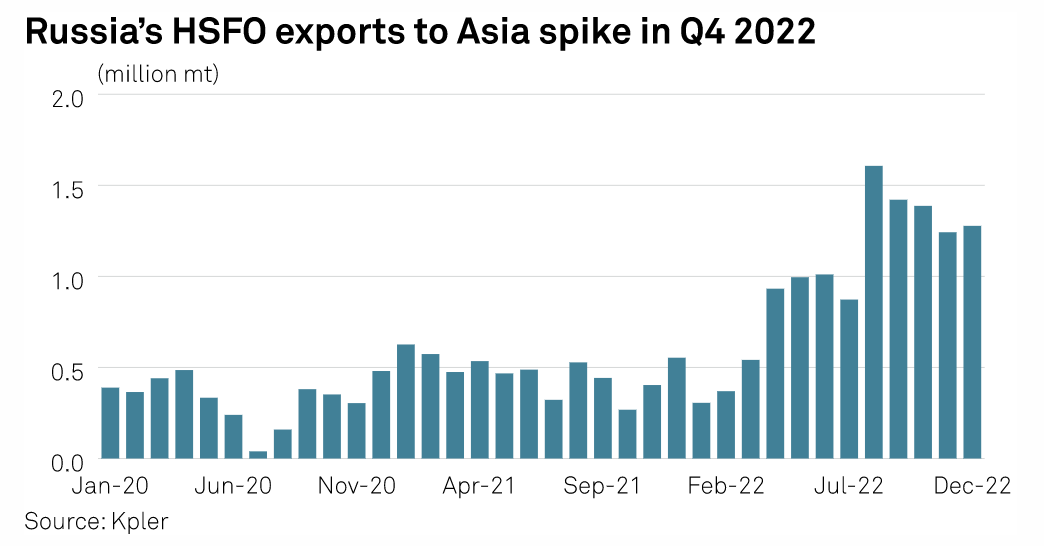

Commodities 2023: Ample Supply Likely To Weigh On Asian HSFO Market

The Asian high sulfur fuel oil market is likely to be bogged down for most part of 2023 by ample Russian supply, despite expectations of steady to strong demand, especially from the downstream marine fuels sector, several traders and analysts said. Russian-origin supply is likely to increasingly find its way east following a ban on the country's oil product exports in 2023. That could tilt the demand-supply balance more toward a market that's likely to be long than balanced, even with expectations of steady HSFO demand from the utility sector and even more so from scrubber-fitted vessels.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Technology & Media

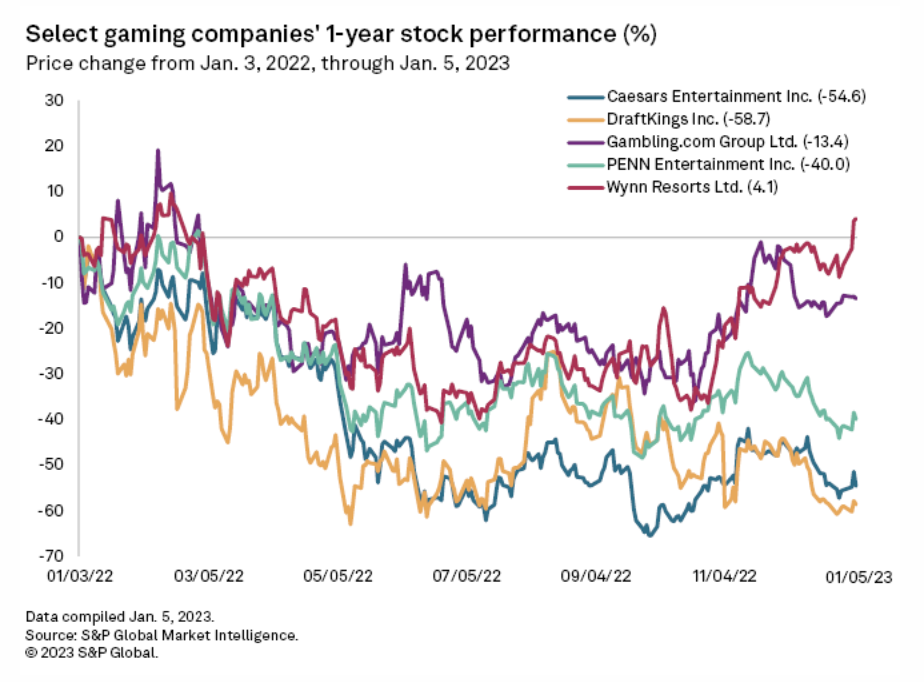

Ohio Sees Strong Launch Of Online Sports Betting Over New Year's Weekend

Legalized online and mobile sports betting got off to a fast start in Ohio. The state, which launched legal sports betting Jan. 1, recorded 11.3 million transactions over the course of New Year's weekend, according to GeoComply, which provides geolocation and anti-fraud solutions to the U.S. iGaming industry. Cincinnati saw the most legal mobile action with just under 1.9 million geolocation transactions, according to GeoComply, followed by Columbus at more than 1.0 million. Cleveland and Toledo tallied 772,000 and 619,000, respectively.

—Read the article from S&P Global Market Intelligence