Discover more about S&P Global’s offerings

Author: John van Moyland, Managing Director and Global Head of S&P Kensho Indices S&P Dow Jones Indices

Published: March 1, 2019

Thirty-eight percent of American workers may need to change occupations by 2030, according to PwC. That means about 45 million people already in the workforce might need to be retrained over the next 11 years.

McKinsey Global Institute has estimated that approximately 50% of the activities people are paid to do, representing USD 16 trillion in costs to the global economy, can be automated using currently available technology.

To read this and more additional content, please read our latest issue of the Indexology® Magazine.

Rapid developments in artificial intelligence (AI) and robotics— coupled with ubiquitous connectivity and vast, easily accessible processing power—are laying the groundwork for fundamental structural changes in the global economy. These mutually reinforcing catalysts are driving exponential innovation across a wide swathe of the economy, reshaping entire industries and creating new ones.

Interestingly, these catalysts are not new in and of themselves. For instance, the early work in modernday artificial intelligence began in the 1950s, even though progress was limited given the lack of necessary processing power; and, of course, robots have been commonplace in manufacturing for well over 30 years. What’s prompting this new era is the compounding effect of developments in each of these areas. For instance, massively powerful and easily accessible computing power has greatly accelerated developments across AI, robotics, and the internet of things. Similarly, rapid developments in AI have greatly enhanced the capabilities of robotics, complex network management, and our ability to make sense of the vast amount of data captured by an increasingly connected world.

It is not purely technical advancements that are facilitating this revolution: a cultural shift towards a more open, sharing economy has also lowered the barriers to entry for many innovative startups. The open source community has evolved to include valuable intellectual property and sophisticated foundational components made freely available by large companies, such as Amazon, Google, and Facebook, for use by third parties. Couple that with ondemand services, such as effectively limitless computing power, and it’s easy to see how many traditional barriers to entry have been lowered across many industries.

We now stand on the cusp of this new era, the so-called Fourth Industrial Revolution. A term coined by Klaus Schwab of the World Economic Forum (WEF), it refers to this period of pervasive change in which the characteristics of man and machine begin to merge, whereby human capabilities are enhanced by genetic engineering and wearable and implantable technology, and machines acquire human characteristics, including cognitive capabilities. The WEF uses the term cyber-physical systems to describe the symbiosis of man and machine.

Some have argued that the innovation and change underway today is simply an extension of the Third Industrial Revolution, which heralded the introduction of computers and the digital era in the late 1960s/ early 1970s. However, the Fourth Industrial Revolution represents a step change both in terms of the rate of change and the nature of it. The digital era is transitioning from one largely involving the automation of rote tasks to one that now includes the advanced cognitive capabilities typically associated with humans. The rate and breadth of change anticipated over the next decade is also unprecedented, resulting in what is likely to be a very differentlooking world.

What is the Impact?

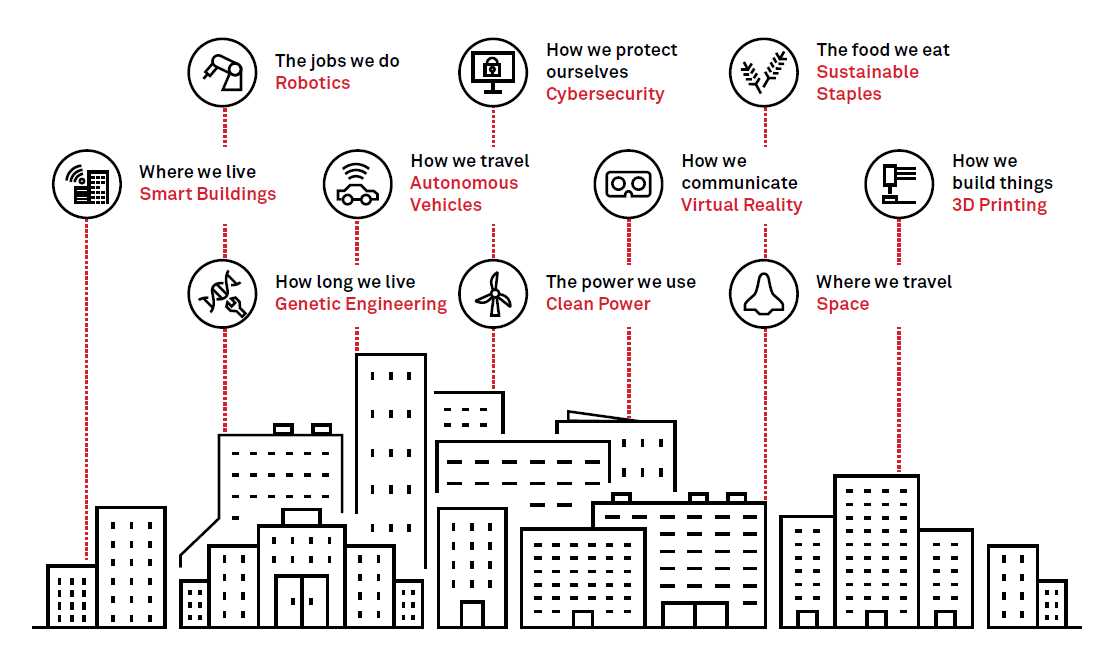

The Fourth Industrial Revolution has the potential to impact virtually every facet of our lives, including the buildings we live in, the way (and where) we travel, the jobs we do, how we communicate, and how long we live. As indicated by the statistics in the beginning of this article, the impact on our lives has the potential to be significant, particularly for those in developed countries. The global workforce could undergo similar degrees of dislocation seen in prior industrial revolutions when developed nations moved away from agrarian economies.

The Fourth Industrial Revolution describes the next industrial era in which the characteristics of man and machine begin to merge, whereby human capabilities are enhanced by genetic engineering and wearable and implantable technology, and machines acquire human characteristics, particularly cognitive capabilities.

However, as the world’s population has increased exponentially, the absolute numbers of those affected will be unprecedented should these predictions come to fruition. There is one important difference to note: the demographics are very different this time around. In the context of an aging population, it has been argued that we require as much automation and as many workers as possible in order to meet our future aspirations for economic growth. The challenge is likely to be far less about a lack of jobs for human workers than about how to retrain and redeploy millions of people.

What Does All This Mean for Investors?

Periods of upheaval pose both opportunities and risks for investors. Just as the internet revolution of the 1990s presented investors with significant opportunities, particularly in Technology and Telecommunications, the Fourth Industrial Revolution may do so as well. In this case, given the unprecedented breadth of its predicted impact, it may be particularly important to understand which industries could be disrupted and which new ones might emerge.

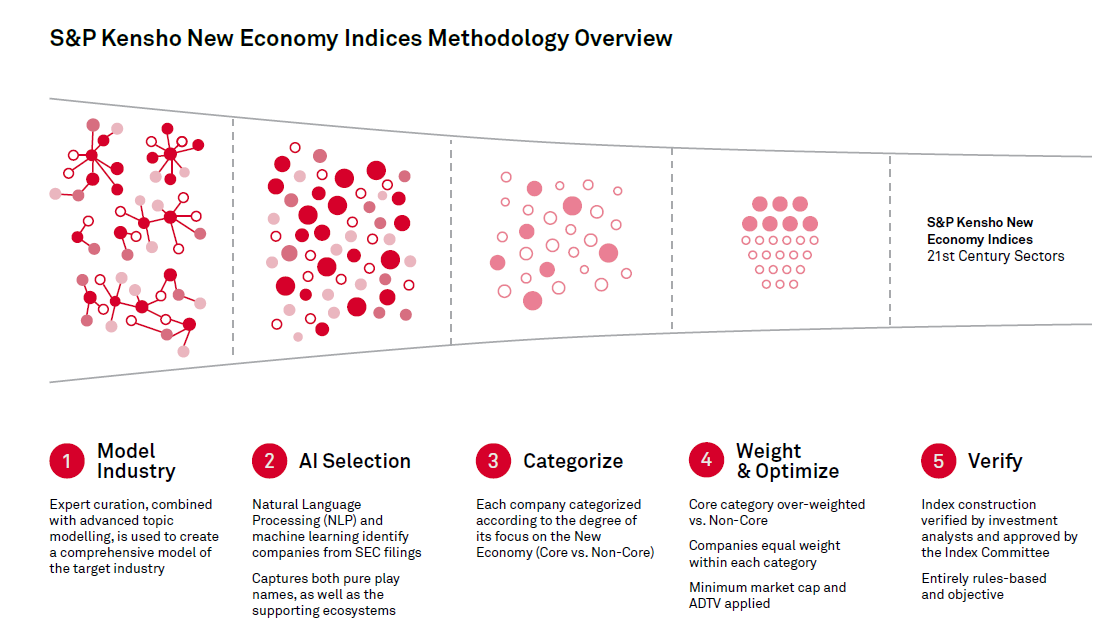

The traditional tools available to help investors understand company exposures, such as the common company classification schemes prevalent today, may not be very well-suited to identifying specific areas of exponential innovation and disruption. While a perfectly legitimate lens with which to view the world, traditional sector and industry classifications are largely functionally oriented, a reflection of a manufacturing-oriented economy. A market- or outcomebased classification scheme is more suitable for capturing specific innovative areas of the new economy. Given the degree of complexity of supply chains today, it is also important to consider the entire ecosystem of companies, i.e. pure plays, supply chain companies, and service providers, when evaluating the full economic exposure in a given sector. On top of that, it may help to look beyond the traditional cues used to categorize a company’s activities, such as revenue filters, in order to understand which companies are driving innovation in this dynamic and rapidly changing environment. They are generally making large, strategic bets—ones designed to position them at the forefront of their industries in the years to come. New approaches are required to capture these forward-looking strategies in a systematic way and may help investors skate to where the puck is going, rather than where it has already been.

Existing broad-based market indices do not precisely capture these areas of innovation. In fact, we know that history does not favor the incumbent: the average tenure in the S&P 500 was 15 years in 2015, down from 65 years in 1920, and, if current projections hold true, 40% of the current Fortune 500 companies will not be around in 2025. Understanding the makeup of the “New Economies” may be an interesting complement to the use of existing broad-based market indices, providing a bridge between the economies of today and those of tomorrow as they develop.

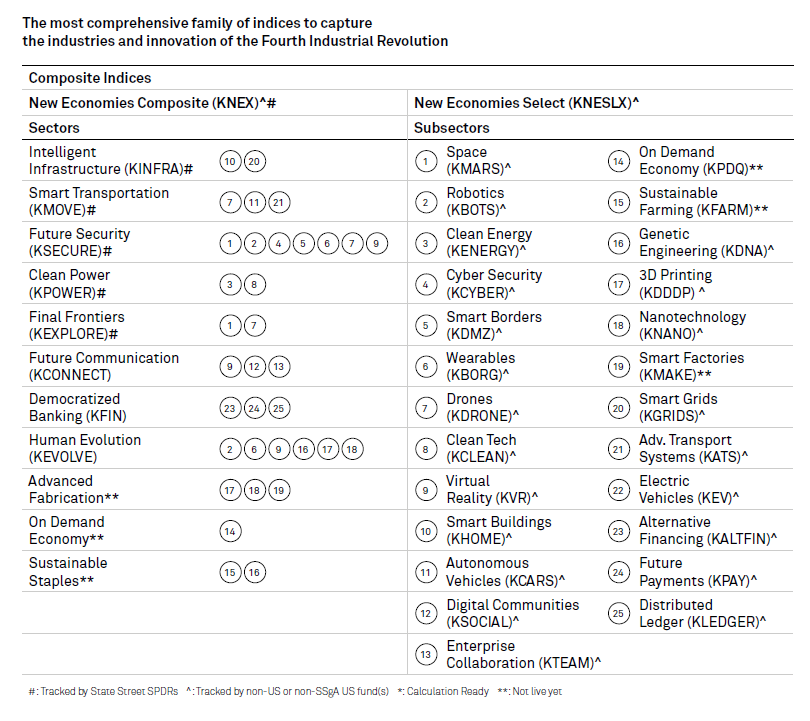

In 2015, Kensho Technologies, LLC, now a subsidiary of S&P Global, committed to providing market participants with the tools necessary to understand and capture the opportunities presented by the Fourth Industrial Revolution. Using a new and innovative adaptive classification framework and employing cuttingedge AI to identify the companies propelling this revolution, Kensho has produced a comprehensive, and investable, view of the Fourth Industrial Revolution. The resulting family of indices consists of 25 subsectors, each representing an area of exponential innovation, 11 sectors that are the aggregations of one or more subsectors (in whole or in part), and composite indices providing investors with the broadest exposure to this phenomenon.

Please visit spdji.com/index-family/kensho-new-economies/all to learn more.